New analysis from UKHospitality and the British Retail

Consortium reveals that the sectors collectively pay one third of

all business rates in the UK, while accounting for 9% of the

economy.

Both organisations are united in their call for the Chancellor to

implement a fairer level of business rates for hospitality and

retail at the Budget, which will rebalance a system that unfairly

punishes our high streets and town centres. This was a manifesto

pledge from Labour ahead of the election.

A lower rate for hospitality and retail, which together employ

around six million people, would unlock investment in our high

streets, while also stemming the loss of shops, pubs, restaurants

and hotels, and the jobs that rely on them.

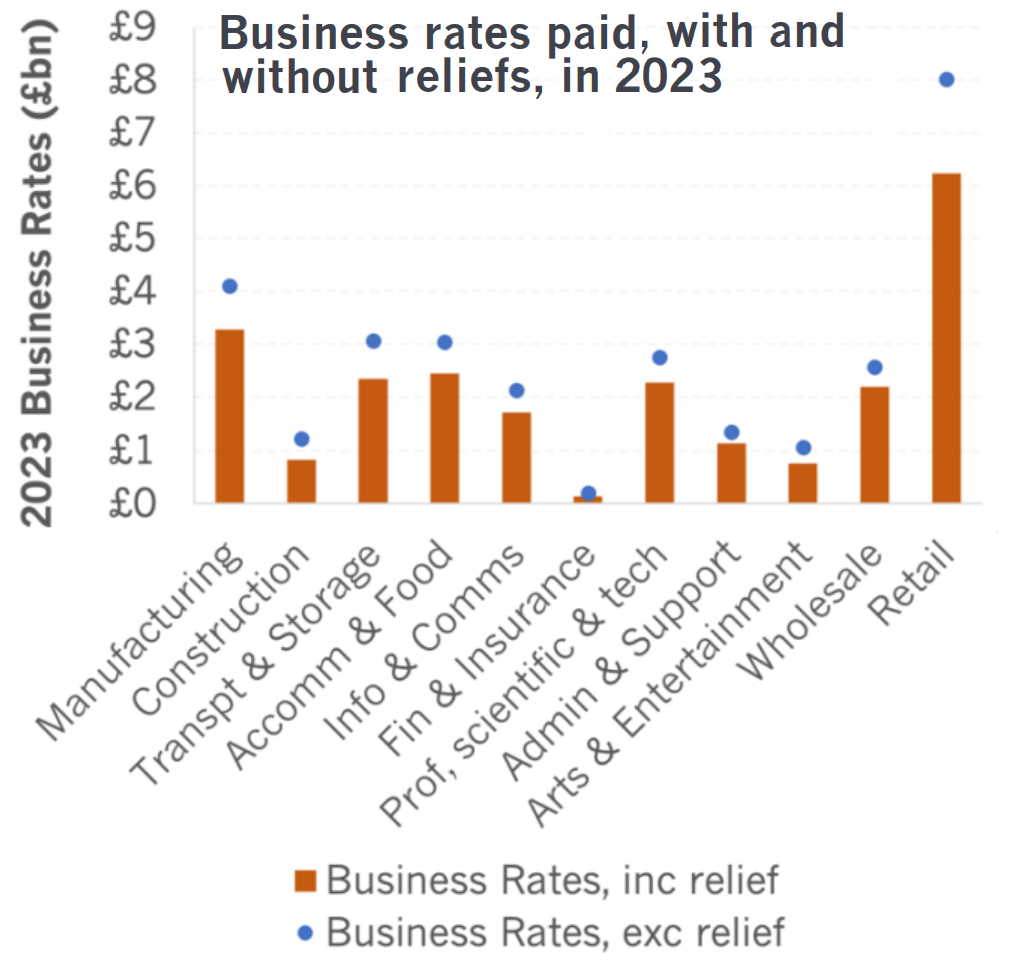

In 2023/24, retail and hospitality businesses combined to pay

almost £9 billion in business rates, 34% of the overall rates

bill, while accounting for only 9% of the overall economy.

Current business rates relief for retail and hospitality is set

to end on 31 March, costing the sectors a combined £2.5bn. That

would take their bill up to £11bn, accounting for 44% of total

rates.

Helen Dickinson, Chief Executive of the British Retail

Consortium, said:

“Consumers want diverse and thriving high streets, but this is

held back by the broken business rates system. It is the biggest

barrier to local investment and prevents the creation of new

shops and jobs.

“Already, the industry pays far more than its fair share – retail

accounts for 5% of the economy, but pays 7.4% of all business

taxes, and over 20% of all business rates. The Budget is a great

opportunity to right this imbalance, ensuring that retail pays a

fairer level of business rates.”

Kate Nicholls, Chief Executive of UKHospitality,

said:

“Hospitality is at the heart of our communities but the enormous

value it delivers both socially and economically is under threat

from the inflated business rates bill the sector has to foot.

“High street businesses paying one third of all business rates is

absurd and one of the primary reasons why we see our businesses

facing financial challenges – it makes running a pub, bar, café

or restaurant, to name a few, incredibly expensive.

“Introducing a reduced level of business rates for the high

street at the Budget can unlock millions in investment – from new

venues to more jobs. Crucially, it would save our high street

from countless closures if hospitality had to bear a billion

pound business rates hike in April.”