Covering the five weeks 25 August – 28 September

2024

-

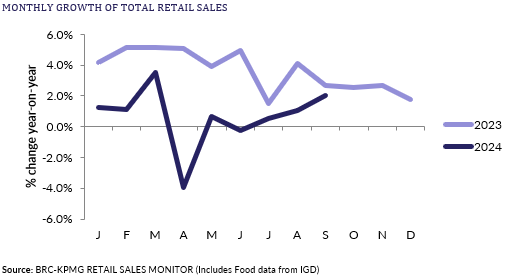

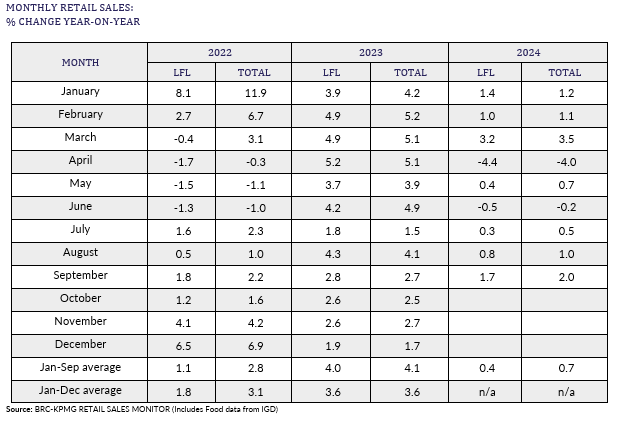

UK Total retail sales

increased by 2.0% year on year in September, against a growth

of 2.7% in September 2023. This was above the 3-month average

growth of 1.2% and the 12-month average growth of 1.1%.

-

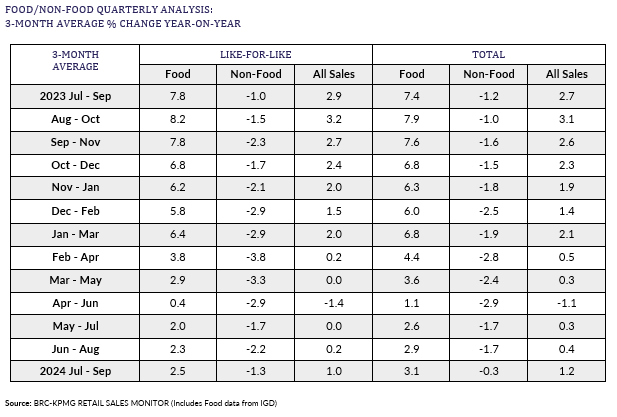

Food sales increased 3.1% year on year over

the three months to September, against a growth of 7.4% in

September 2023. This is below the 12-month average growth of

4.4%. For the month of Sep, Food was in growth

year-on-year.

-

Non-Food sales decreased 0.3% year on year

over the three-months to September, against a decline of 1.2%

in September 2023. This is above the 12-month average decline

of 1.7%. For the month of September, Non-Food was in growth

year-on-year.

-

In-store Non-Food sales over the three months

to September decreased 1.5% year on year, against a growth of

0.3% in September 2023. This is above the 12-month average

decline of 1.9%.

-

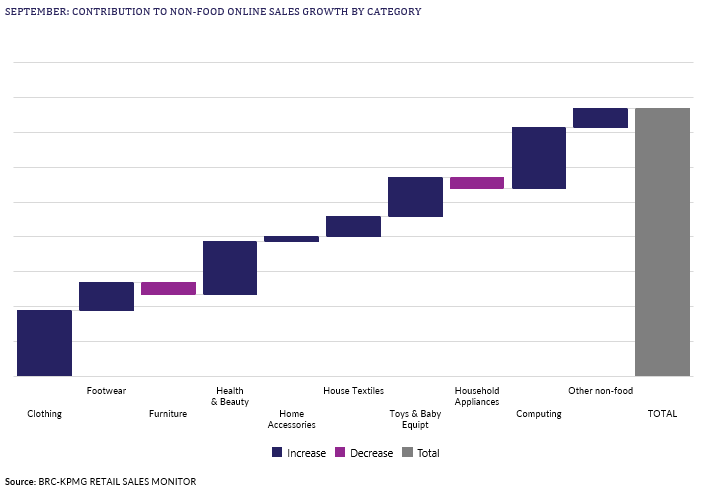

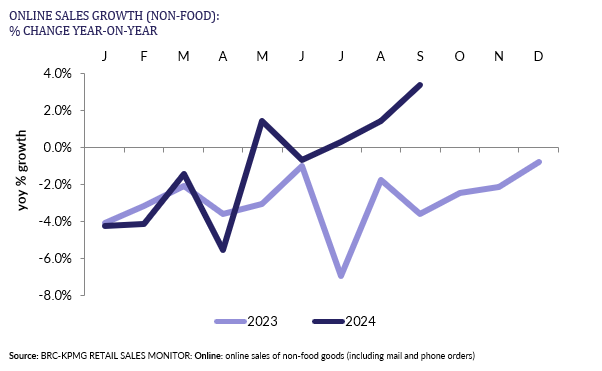

Online Non-Food sales increased by 3.4% year

on year in September, against an average decline of 3.6% in

September 2023. This was above the 3-month average increase of

1.9% and above the 12-month average decline of 1.1%.

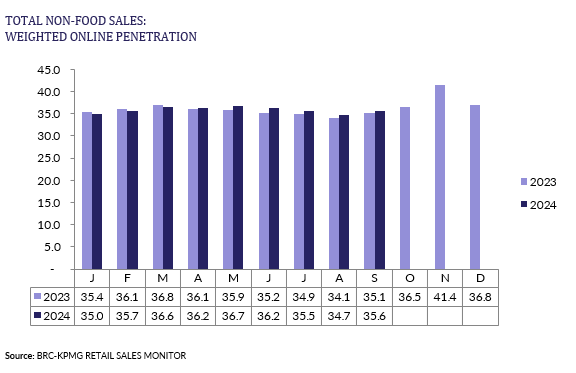

- The online penetration rate (the proportion

of Non-Food items bought online) increased to 35.6% in September

from 35.1% in September 2023. This was below the 12-month average

of 36.4%.

Helen Dickinson OBE, Chief Executive

of the British Retail Consortium, said:

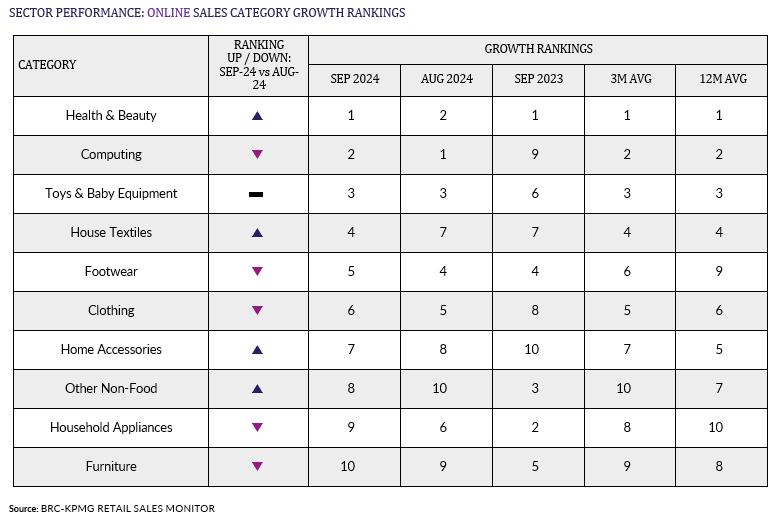

“Retail sales saw the strongest growth in six months as non-food

performed better than expected. As Autumn rolled out across the

UK, shoppers sought to update their wardrobes with coats, boots

and knitwear. The start of the month also saw a last-minute rush

for computers and clothing for the new academic year. Ongoing

concerns of consumers about the financial outlook kept demand low

for big ticket items such as furniture and white goods.

“The coming months are crucial for the economy as retailers enter

the “Golden Quarter”. But in the face of weak consumer confidence

and the continued high burden of business rates, retailers'

capacity for further investment is limited. As a result,

retailers are holding their breath ahead of the Budget as they

work out their investment strategies for the coming year.

Decisive action from the Chancellor, such as introducing a 20%

Retail Rates Corrector, would help to drive investment and

economic growth up and down the country.”

Linda Ellett, UK Head of Consumer, Retail & Leisure,

KPMG, said:

“September saw modest, but welcome, sales growth for

retailers. Children's clothing, footwear and accessories

saw a boost from the start of the school year, with household

budgets feeling slightly less constrained for some parents

compared to last year. Similarly, the return to work after

summer holidays also led to an upturn in adult clothing and

footwear sales. With record rainfall levels in some

counties, the cold and wet weather in September sped up purchases

of extra layers and wet weather gear.

“With energy prices having again risen, all eyes now turn to the

Budget and what impact that will have on household discretionary

spending in the final quarter of the year.”

Food & Drink sector performance | Sarah Bradbury,

CEO, IGD, said:

“Shopper confidence remained stable

in September after a summer buoyed by sport. As shoppers turn

their focus to the upcoming winter months, news of a difficult

Autumn Budget and rising energy prices will likely cause a

downturn in confidence with cost-of-living concerns remaining

front and centre in shoppers' minds.

“Growth in the grocery retail market slackened with the arrival

of autumn. September's sales were still ahead year-on-year, but

the pace of increase was down versus August, no doubt depressed

by the wet weather as well as cautionary economic messages from

the government.

“With the golden quarter just beginning, retailers have been

implementing seasonal ranging earlier than ever, determined to

make the most of the coming key trading period.”