New research, unveiled today by the British Retail Consortium

(BRC) in its Budget submission, shows

that the retail industry is overtaxed compared to other sectors

of the economy.

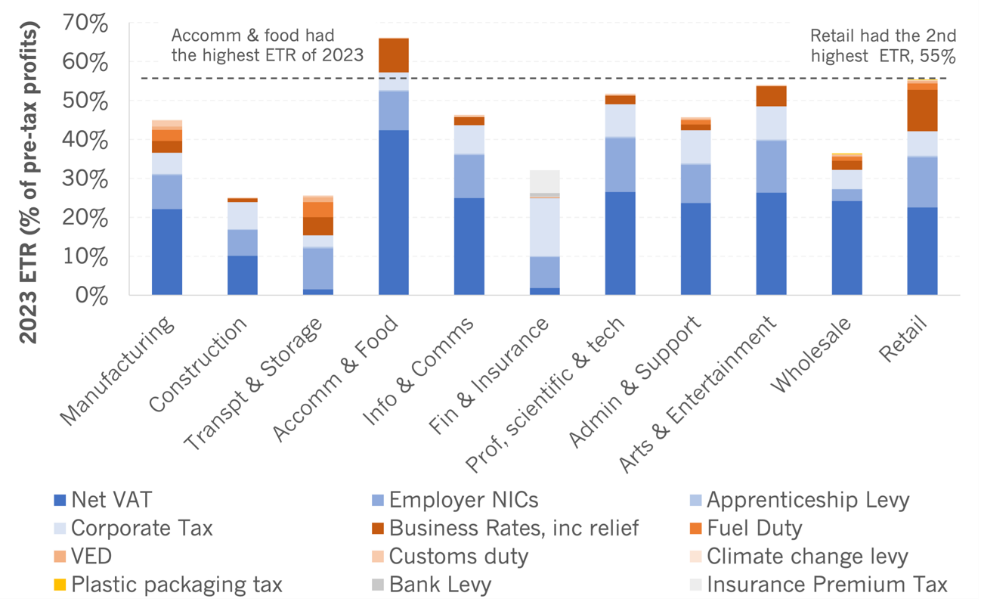

Retail pays 7.4% of all business taxes (£33bn), a share 1.5 times

greater than its share of the overall economy (5% GDP). This bill

amounts to 55% of the industry's pre-tax profits, the highest

proportion, along with hospitality, of all main business sectors.

Of this total tax bill, 11% of profits is made up of business

rates, the highest of all business sectors.

The effect of this tax burden is stark, with shuttered shops and

declining high streets in every corner of the country. This was

recognised in Labour's election manifesto which stated

“The current business rates system disincentivises

investment, creates uncertainty and places an undue burden on our

high streets.” The UK has lost 6,000 shops in the last five

years: in two-thirds of these closures, business rates had a

material impact in the decision-making process. Without action,

up to 17,300 shops could close over the next decade.

More widely, it is holding back investment in pay and upskilling

for colleagues, and in the technology that will boost

productivity, support decarbonisation, and drive economic growth.

The findings come as the BRC puts forward its submission to the

Autumn Budget, which calls on the government to introduce a 20%

Retail Rates Corrector – a 20% adjustment to bills for all retail

properties. This would meet the government's manifesto commitment

to reform the business rates system and to restore Britain's

declining high streets, and would immediately unlock investment

and growth, another priority for the government.

Helen Dickinson, Chief Executive of the British

Retail Consortium, said:

“Our research conclusively proves what retailers have known for

years: the industry is paying far more than its fair share of

tax. The impact of this is clear to see on high streets across

the country, with shops shut, jobs lost and a social as well as

economic cost. The rates bill also means missed opportunities as

other investments, which would drive growth in the longer term,

don't happen.

“The Chancellor has a golden opportunity to fix this and use the

scale of the industry to help deliver some of the government's

priorities. Introducing a 20% Retail Rates Corrector would be a

decisive move that levels the playing field between different

sectors of the economy and is the best way to achieve the

government's commitment of a tax ‘fairer for bricks and

mortar businesses'. It gives an immediate return allowing

retailers to move further and faster with investments that play a

critical part in driving growth, and in restoring our high

streets right across the country.”

-ENDS-

Notes:

-

Britain loses 6,000

storefronts in five years

-

Retail, Rates and Recovery:

How business rates reform can maximise retail's role in

levelling up

-

Reforming Business Rates: The

Jeopardy of Inaction

- New BRC research

- It presents a first comprehensive cross-sectoral analysis

of taxes borne by businesses, covering £441bn of taxes paid

and £324bn of taxes collected by businesses, together 78% of

all public receipts. The remaining 22% is dominated by taxes

wholly or largely paid by households and by unincorporated

self-employed individuals on their earnings.

- It looks at the main taxes borne by business in retail

and other business sectors: Net VAT. Payroll taxes: employer

national insurance contributions (NICs) and apprenticeship

levy. Corporation tax. Business rates, net of reliefs. Other

taxes: fuel duty, vehicle excise duty (VED), customs duty,

climate change levy and the plastic packaging tax.

- The retail sector is compared against 10 comparator

sectors (see chart below). The 11 sectors account for 80% of

the £441bn of taxes borne by businesses in the UK.

- The sector-by-sector assessment of the business tax

burden provides clear evidence that retail is more heavily

burdened by tax than other sectors, and strongly supports the

ongoing focus on reforming business rates to achieve a

fairer, more growth- and jobs-friendly tax system. One that

recognises the economic and social contribution that

property-intensive sectors like retail make in terms of

growth, jobs and local community and that catalyses the

private sector investment that the Chancellor has rightly

identified as critical to the UK's long-term growth

prospects.

- It also underlines the value of considering

sector-specific options and options helping Government to

deliver wider policy priorities (for example a longer term

and more widely applied relief to follow on from the latest

temporary support for retail, hospitality and leisure), and

for those helping to deliver Government priorities elsewhere

(for example on net zero and employment) – options that are

more immediate and straightforward to deliver.

- Extract: Taxes borne by business as a % of profits:

sectoral breakdown in 2023

Source: ONS, HMRC and OBR publications (*ETR = Effective

Tax Rate)

- Following review of the research findings, BRC's Budget

Submission proposes a Retail Rates Corrector:

- Government should apply a 20% Retail Rates Corrector (a

downward adjustment of 20%) to business rates bills for

retail properties of all sizes and in all locations.

- Should commence in April 2025, without subsidy control

restrictions, and be combined with administration

improvements and relief to bring empty properties back into

use.

- Retail Rates Corrector would cost £1.8bn and would

immediately unlock economic growth. If Treasury seeks to fund

this within the rates system, it should look outside retail,

given the impact of the existing business tax burden on

retail and retailers' ability to invest.

- Alongside the Corrector, a method needs to be found to

lessen the impact for those companies who currently receive

the Retail, Hospitality and Leisure Relief Scheme, as this

has been much needed support in recent years.

-

BRC Budget Submission

– other key policy recommendations include:

- Consider restoring tax-free shopping for international

visitors, starting with an announcement to review the last

Government's costing estimates of the decision to remove the

scheme.

- Enable a significant increase in business support for

people in need by extending VAT relief on product donations

to charities for onward sale to direct donations to

individuals and households. Start by publishing the

consultation on VAT relief on everyday donations, postponed

by the election.

- Accelerate the move to a circular economy for goods by

lowering or removing VAT on reused, repaired and refurbished

goods and services.

- Ensure that fees raised by Extended Producer

Responsibility (EPR) are ringfenced for investment in

improved recycling infrastructure which will increase

recycling rates and drive the circular economy.

- Ensure that retailers have access to affordable financing

as they fund the operation of the Deposit Return Scheme (DRS)

Deposit Management Organisation (DMO) until the scheme is up

and running in October 2027.

- Rebalance the burden of energy costs from electricity to

gas by reducing electricity non-commodity costs and reforming

the system of energy intensive subsidies.

- Ensure the extension of the Payment Systems Regulator's

(PSR) existing market reviews into cross-border interchange,

card scheme and processing fees to further include commercial

interchange fees and to ensure that the reviews result in

meaningful action for merchants and customers.