Period Covered: 01 – 07

July 2024

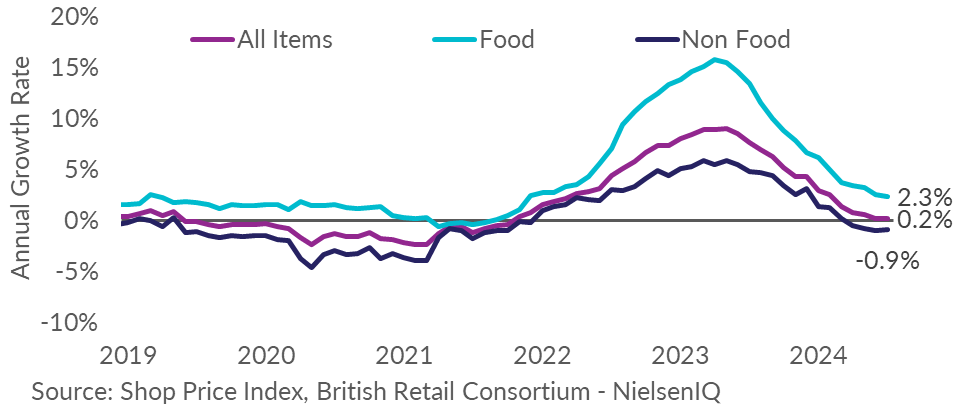

- Shop Price annual inflation remained unchanged at 0.2% in

July. This is below the 3-month average rate of 0.3%. Shop price

annual growth remained at its lowest rate since October 2021.

- Non-Food remained in deflation at -0.9% in July, up from

-1.0% in the preceding month. This is in line with the 3-month

average rate of -0.9%. Inflation is at its lowest rate since

October 2021.

- Food inflation slowed to 2.3% in July, down from 2.5% in

June. This is below the 3-month average rate of 2.7%. The annual

rate continues to ease in this category and inflation is at its

lowest rate since December 2021.

- Fresh Food inflation slowed further in July, to 1.4%, down

from 1.5% in June. This is below the 3-month average rate of

1.6%. Inflation is its lowest rate since November 2021.

- Ambient Food inflation decelerated to 3.6% in July, down from

3.9% in June. This is below the 3-month average rate of 4.1% and

is the lowest rate since April 2022.

|

|

OVERALL SPI

|

FOOD

|

NON-FOOD

|

|

% Change

|

On last year

|

On last month

|

On last year

|

On last month

|

On last year

|

On last month

|

|

Jul-24

|

0.2

|

-0.1

|

2.3

|

0.1

|

-0.9

|

-0.2

|

|

Jun-24

|

0.2

|

-0.2

|

2.5

|

-0.1

|

-1.0

|

-0.2

|

Note: Month-on-month % change refers to changes in the

level of prices.

Helen Dickinson, Chief Executive of the British Retail

Consortium, said:

“Shop Price Inflation in July remained unchanged on the previous

month. Non-food price deflation continued, albeit at a slower

rate than June. Holiday makers could pick up bargain summer wear

and summer reads as clothing and footwear prices fell for the

seventh consecutive month amidst persistent weak demand, and the

prices of books fell. The 2023 declines in global food commodity

prices continued to feed through, helping bring down food

inflation rates over the first seven months of 2024. However this

shows signs of reversing, suggesting renewed pressure on food

prices in the future. Sports gatherings for Wimbledon and the

Euros benefitted from discounted snacking items such as crisps

and soft drinks.

“UK households suffered from high levels of inflation in 2022 and

2023 and can celebrate inflation levels returning to normal over

the first half of this year. But, with the outlook for commodity

prices remaining uncertain due to the impact of climate change on

harvests domestically and globally, as well as rising

geopolitical tensions, renewed inflationary pressures could be

lurking just over the horizon.”

Mike Watkins, Head of Retailer and Business Insight,

NielsenIQ, said:

“As we cycle through high inflation

comparatives from a year ago we can expect a lower level of

inflation for a number of months to come. But with the squeeze on

household finances continuing, consumer confidence only slowly

improving, and poor summer weather so far, retailers will still

need to keep any price increases to a minimum to encourage

shoppers to spend.”