Covering the five weeks 25 February – 30 March

2024

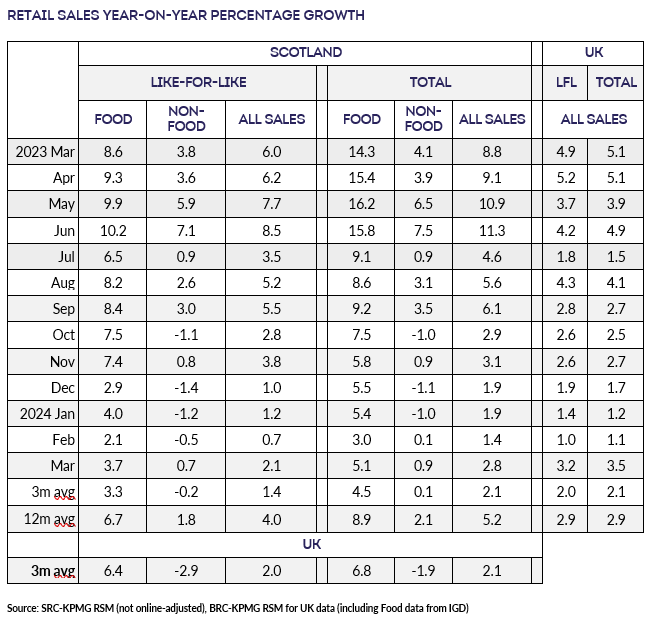

- Total sales in Scotland increased by 2.8% compared with March

2023, when they had grown 8.8%. This was above the 3-month

average increase of 2.1% and below the 12-month average growth of

5.2%. Adjusted for inflation, the year-on-year growth was 1.5%.

- Scottish sales increased by 2.1% on a Like-for-like basis

compared with March 2023, when they had increased by 6.0%. This

is above the 3-month average increase of 1.4% and below the

12-month average growth of 4.0%.

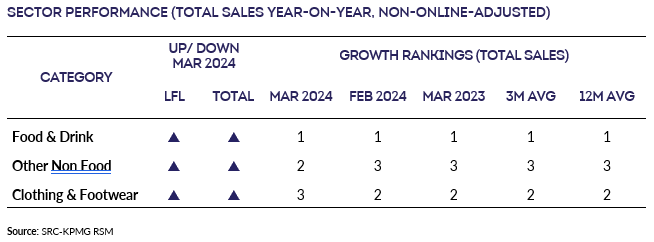

- Total Food sales increased by 5.1% versus March 2023, when

they had increased by 14.3%. March was above the 3-month average

growth of 4.5% and below the 12-month average growth of 8.9%. The

3-month average was below the UK level of 6.8%.

- Total Non-Food sales increased by 0.9% in March compared with

March 2023, when they had increased by 4.1%. This was above the

3-month average decrease of 0.1% and below the 12-month average

growth of 2.1%.

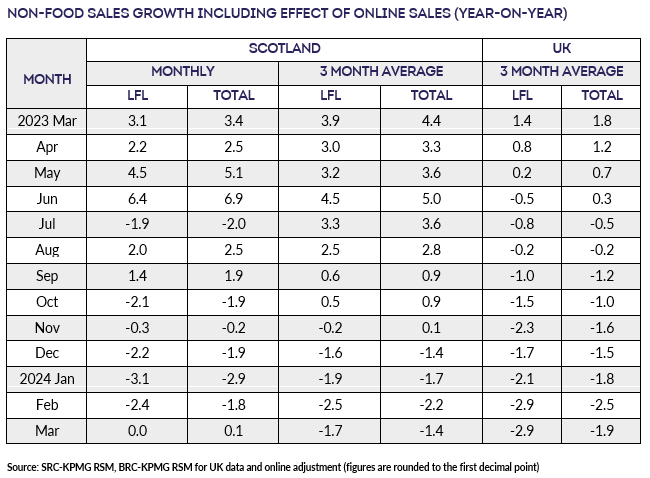

- Adjusted for the estimated effect of Online sales, Total

Non-Food sales increased by 0.1% in March versus March 2023, when

they had increased by 3.4%. This was above the 3-month average

decline of 1.4% and below the 12-month average growth of 0.8%.

Ewan MacDonald-Russell, Deputy Head | Scottish Retail Consortium

“Clearly one swallow doesn't make a summer, but these positive

figures for March are a balm for hard-pressed retailers in

Scotland after many months of difficult trading. The data shows a

pick-up in demand across food and non-food categories with the

total value of retail sales, once adjusted for shop price

inflation, growing for the first time since last June. This was

buoyed in great part by the early Easter and associated

improvement in footfall.

“Sales of home accessories, home textiles and health and beauty

performed well, as did grocery and toys as Scots readied for

Easter and the school break. In contrast DIY, garden furniture,

and larger household appliances fared less well.

“Enthusiasm over March's sprightlier results is understandable

after a sustained and difficult period for Scottish retail sales.

However, this needs to be tempered given continuing pressures on

retailers' outgoings and the fact that some Easter related

purchases will have been pulled forward into March. It's too

early to say Scottish retail sales have turned the corner.

However, the continued real terms growth in wages, the easing of

shop price inflation, and the freeze to council tax and

reductions in employee national insurance contributions should

all help support future demand.”

Linda Ellett, UK Head of Consumer, Retail and

Leisure | KPMG

"After a tough start to the year, an early Easter showed the

green shoots of spring with total sales in Scotland increasing by

2.8% in March. Whilst this seems disappointing compared to the

increase of 8.8% last March, this was above the 3-month average

increase of 2.1% and when adjusted for inflation is a positive

1.5% year-on-year growth.

“High street sales growth was driven by food and drink, health

and beauty and keen gardeners who headed outside to enjoy the

first days of spring. There were also some signs of green

shoots with more categories starting to see positive sales growth

in March for the first time in months.

“As April signals big increases in the sector's cost base –

through the rise in minimum wage rates and business rate hikes

for the larger high street brands – retailers will be hoping that

the bounce back of March sales is more than just an Easter

blip. Economic indicators are heading in the right

direction with inflationary pressures easing and interest rates

having potentially peaked, however consumer confidence remains

fragile and households continue to keep a close eye on where

their tight budgets are being spent. It remains a

challenging environment, but as we head into the warmer months

retailers will be hoping that stronger consumer confidence will

turn into stronger retail sales, especially in more discretionary

categories such as clothing, following an incredibly difficult

few years."