Sales figures are not adjusted for inflation, however, the

February SPI (BRC) and January CPI (ONS) show inflation running

at higher than normal levels these positive sales figures mask a

likely drop in volumes. As inflation falls in the coming months,

retail sales figures will also naturally fall at the same time.

Covering the four weeks 28 January – 24 February

2024

-

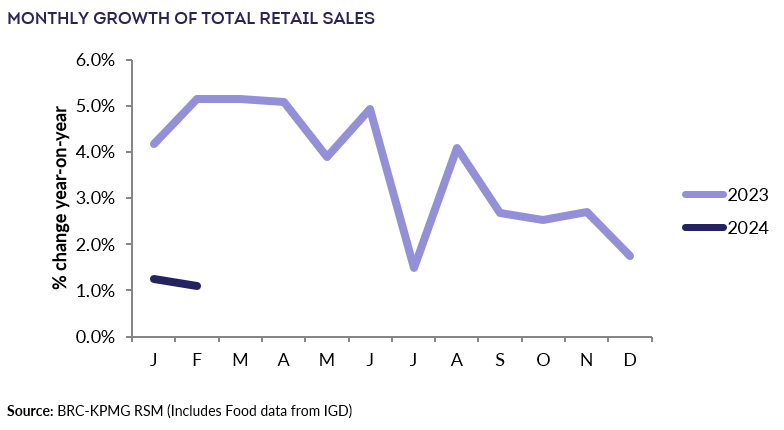

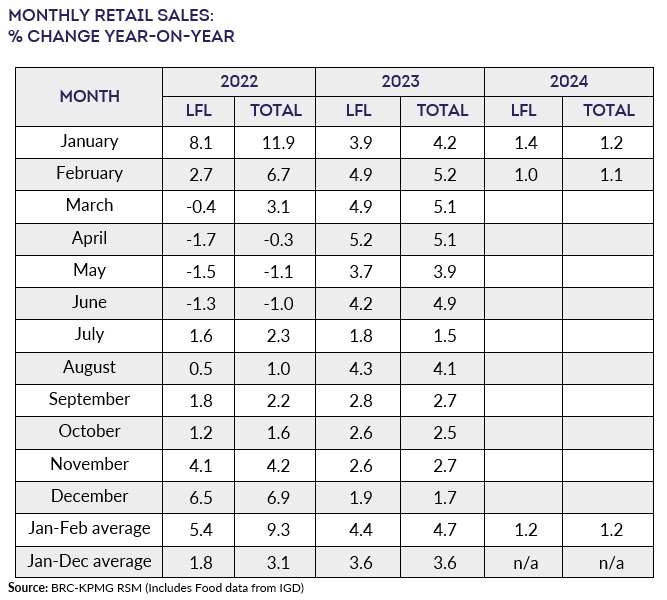

UK Total retail sales

increased by 1.1% year on year in February, against a growth of

5.2% in February 2023. This was below the 3-month average

growth of 1.4% and below the 12-month average growth of

3.1%.

-

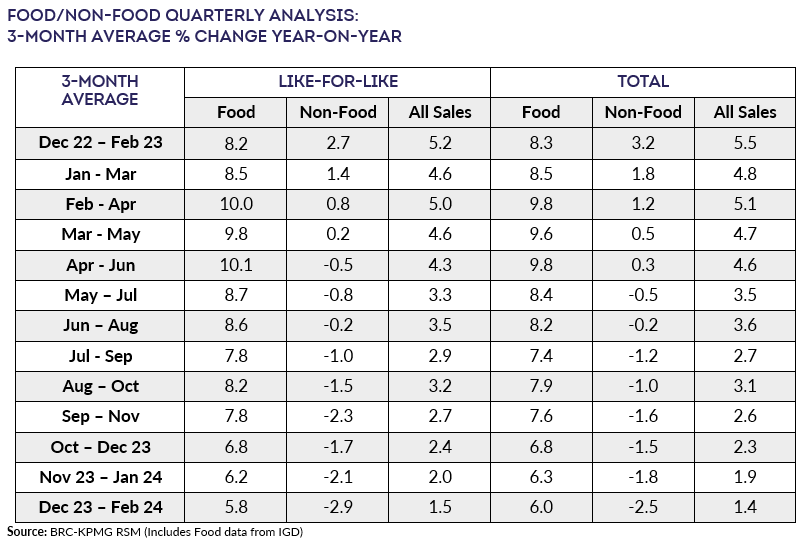

Food sales increased 6.0% year on year over

the three months to February, against a growth of 8.3% in

February 2023. This is below the 12-month average growth of

7.9%. For the month of February, Food was in growth

year-on-year.

-

Non-Food sales decreased 2.5% year on year

over the three-months to February, against a growth of 3.2% in

February 2023. This is steeper than the 12-month average

decline of 0.9%. For the month of February, Non-Food was in

decline year-on-year.

-

In-store Non-Food sales over the three months

to February decreased 2.3% year on year, against a growth of

8.1% in February 2023. This is below the 12-month average

growth of 0.3%.

-

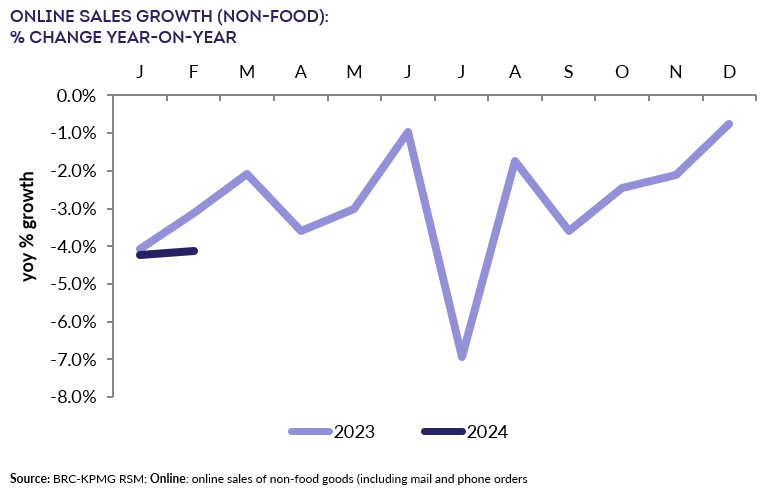

Online Non-Food sales decreased by 4.1% year

on year in February, against a decline of 3.1% in February

2023. This was steeper than the 3-month and 12-month declines

of 2.9%.

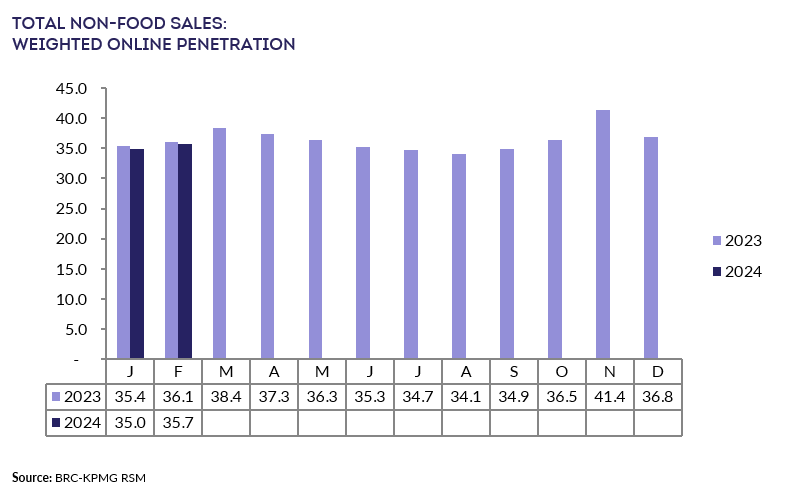

- The online penetration rate (the proportion

of Non-Food items bought online) decreased to 35.7% in February

from 36.1% in February 2023.

Helen Dickinson OBE, Chief Executive

of the British Retail Consortium, said:

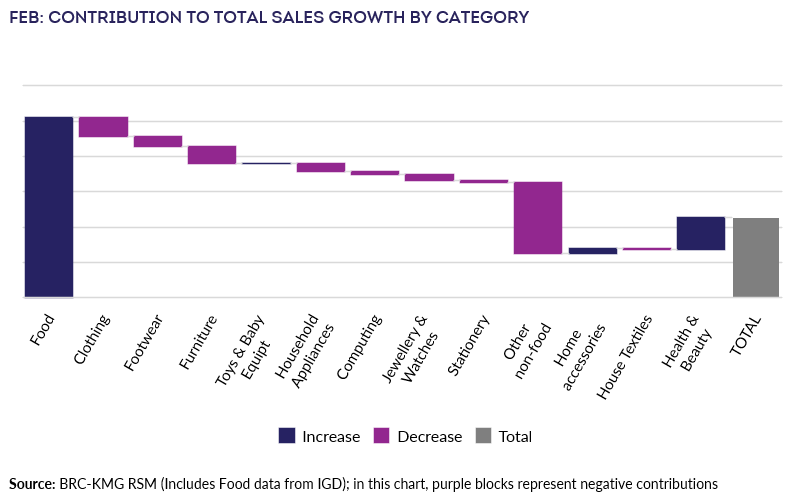

“Consumer demand was dampened by the wettest February on record,

translating into a poor month of retail sales growth. Not even

Valentine’s Day lifted customers out of the gloom, and gifting

products that typically sell well, like jewellery and watches,

failed to deliver. On the sunnier side, rainy weather did

brighten sales of toys, as parents looked for ways to occupy

their children indoors.

“With consumer confidence and demand remaining weak, Government

must find ways to stimulate the economy. Retailers have some

Government induced cost hurdles to jump in the coming months

including a £400m business rates rise based on last September’s

6.7% inflation rate. By using Wednesday’s Budget to reduce this,

the Chancellor will lend a helping hand to much needed investment

in businesses and local communities up and down the country.”

Linda Ellett, UK Head of Consumer Markets, Leisure &

Retail, KPMG, said:

“Cuts in national insurance rates designed to put more money in

people’s pockets have so far failed to translate to a boost to

consumer spend on the high street, with retail sales growth in

February recording a limp 1.1%.

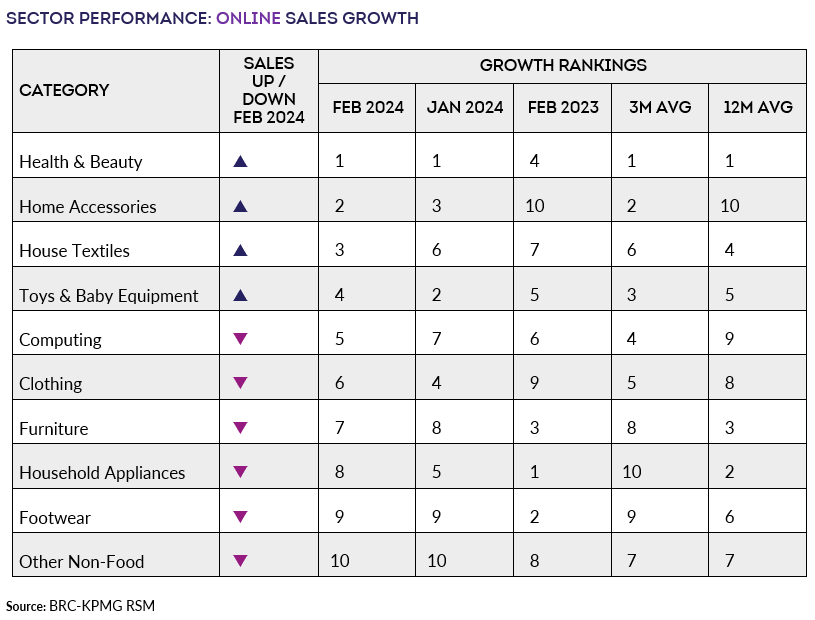

“Health and beauty categories continued to drive sales both on

the high street and online, whilst sales of home and dining

accessories received an unexpected boost last month, as consumers

moved from buying clothes to buying cushions and cooking items.

With food inflation slowing, sales of food and drink remained

strong at 5%, but this was slightly down on January’s

figures.

“As many households continue to adapt budgets to meet higher

essential costs, including higher mortgage rates, consumer

reluctance to get out there and start spending is likely to

remain in the short term. With big increases in labour

costs and business rates just weeks away, adding to an already

stressed cost agenda for retailers, many will be pinning

their hopes on some good news in the Chancellors’ Spring Budget

this week to help kick start a spending revival on the high

street. As inflation continues to slow over the coming months and

household finances are expected to improve, there is some light

at the end of the tunnel for weary households. However, the

assumption that having more spending power will lead to more

spending isn’t cutting through at the moment, and retailers will

continue to face significant downward pressures on demand in the

months to come.“

Food & Drink sector performance | Sarah Bradbury,

CEO, IGD, said:

“The UK grocery market saw sales and volumes both increasing from

last year, with February the third month in a row where volumes

were in year-on-year growth. However, although sales were also up

on last year, they were down compared to the previous month. This

is the fifth month in a row this has occurred, and the trend is

likely to continue as inflation leaves the market.

“Following news that the UK entered a technical recession over

the festive period, shoppers were feeling slightly less positive

in February than they were in January. However, confidence levels

didn’t slip as far as they could have, with the promise of lower

energy bills on the horizon and indications that the recession

could in fact already be over playing a role here.”

-ENDS-

Notes:

- The BRC is calling upon the Chancellor to base the April

business rates rise (which is currently based on September 2023’s

6.7% rise) on the Bank of England’s Q2 forecasted inflation rate

(2.0%).