Covering the four weeks 28 January 2024

– 24 February 2024

According to BRC-Sensormatic IQ

data:

-

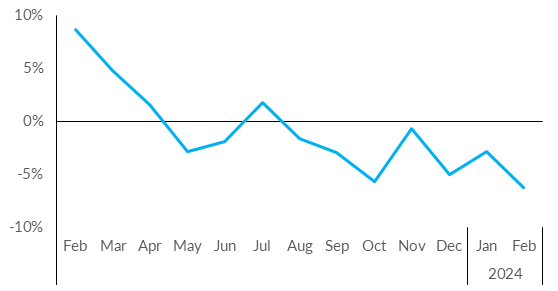

Total UK footfall decreased by 6.2%

in February (YoY), down from -2.8% in January.

-

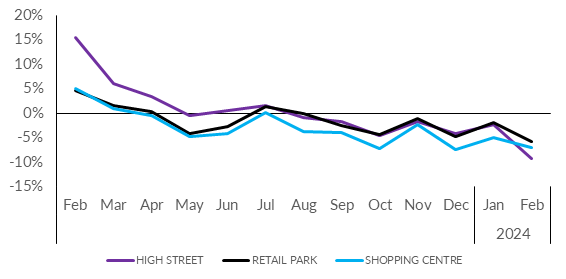

High Street footfall decreased by

9.3% in February (YoY), down from -2.3% in January.

-

Retail Parks footfall decreased

by 5.8% in February (YoY), down from -1.8% in January.

-

Shopping Centre footfall

decreased by 7.0% in February (YoY), down from

-5.0% in January.

- All UK nations saw a fall in footfall year on year.

Scotland saw the smallest YoY drop in footfall at

-3.2%. England saw a YoY drop in footfall at

-6.6%. This was followed by Northern Ireland

at -7.1% and Wales at -8.0%.

Helen Dickinson, Chief Executive of the British Retail

Consortium, said:

“Footfall experienced its biggest fall since the pandemic. One of

the wettest Februarys on record, exacerbated by train strikes at

the start of the month, meant shoppers visited fewer stores, with

high streets most affected. London, where footfall had been

outperforming other major cities in the UK, saw one of the most

significant declines.”

“With these figures showing the UK underperforming compared to

other developed markets, it’s time the government took action to

drive tourist footfall and spending across the UK. Since the end

of VAT-free shopping for tourists in 2021, the UK has been at a

competitive disadvantage compared to its European counterparts.

With footfall in major hubs trending downwards in recent months,

the Chancellor must reinstate VAT-free shopping in his budget to

support businesses and jobs across the UK.”

Andy Sumpter, Retail Consultant EMEA for Sensormatic

Solutions, commented:

“February saw a collision

course of disruptive forces negatively impacting store traffic,

meaning store visits dipped to their lowest ebb since the

pandemic. Prior to any energy price cap reduction, and

with squeezed spending budgets, the confirmation of the UK’s

‘technical recession’ in 2023 appears to have weakened consumer

confidence. The wettest February on record probably didn't

help, and even Valentine’s Day, which usually provides a frisson

of footfall, failed to woo shoppers into store. With the

Bank of England signalling the UK’s economy may already be

recovering from what it describes as a mild recession, retailers

will be hoping signs of an upturn will translate into store

traffic and spend, with many looking towards the prospect of an

early Easter in March to bring about a change of fortunes.”

MONTHLY TOTAL UK RETAIL FOOTFALL (% CHANGE

YOY)

UK FOOTFALL BY LOCATION (% CHANGE YOY)

TOTAL FOOTFALL BY NATION AND REGION

|

GROWTH RANK

|

NATION AND REGION

|

Feb-24

|

Jan-24

|

|

1

|

Yorkshire and the Humber

|

-1.4%

|

-2.6%

|

|

2

|

East of England

|

-1.7%

|

-2.9%

|

|

3

|

South West England

|

-2.3%

|

-1.3%

|

|

4

|

North West England

|

-3.1%

|

-2.8%

|

|

5

|

Scotland

|

-3.2%

|

-2.7%

|

|

5

|

East Midlands

|

-3.3%

|

-2.2%

|

|

7

|

North East England

|

-3.7%

|

-6.0%

|

|

8

|

West Midlands

|

-3.9%

|

-1.0%

|

|

9

|

South East England

|

-4.8%

|

-3.8%

|

|

10

|

London

|

-6.2%

|

-1.7%

|

|

11

|

England

|

-6.6%

|

-2.6%

|

|

12

|

Northern Ireland

|

-7.1%

|

-6.8%

|

|

13

|

Wales

|

-8.0%

|

-4.5%

|

TOTAL FOOTFALL BY CITY

|

GROWTH RANK

|

CITY

|

Feb-24

|

Jan-24

|

|

1

|

Liverpool

|

1.6%

|

1.5%

|

|

2

|

Leeds

|

1.3%

|

1.5%

|

|

2

|

Edinburgh

|

0.2%

|

3.2%

|

|

4

|

Bristol

|

-2.1%

|

-2.9%

|

|

5

|

Belfast

|

-3.1%

|

-5.3%

|

|

6

|

Manchester

|

-3.7%

|

-2.8%

|

|

7

|

Cardiff

|

-4.2%

|

-4.6%

|

|

8

|

Birmingham

|

-4.4%

|

-2.6%

|

|

9

|

Glasgow

|

-4.6%

|

-7.0%

|

|

10

|

Nottingham

|

-5.0%

|

-5.5%

|

|

11

|

London

|

-6.2%

|

-1.7%

|

-ENDS-

Methodology:

All figures are calculated using precise shopper numbers entering

retail stores across the UK, whichever destination they are

located.