Sales figures are not adjusted for inflation. Given that both the

September SPI (BRC) and August CPI (ONS) show inflation running

at higher than normal levels, the rise in sales masked a likely

drop in volumes once inflation is accounted for. Like-for-like

data has been moved from the bullets to the tables at the bottom.

Covering the five weeks 27 August – 30 September

2023

-

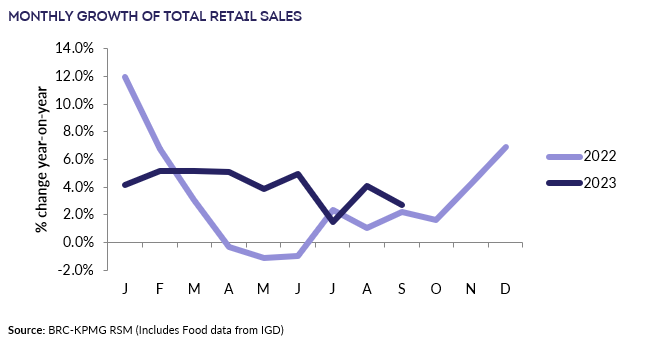

UK Total retail sales

increased by 2.7% in September, against a growth of 2.2% in

September 2022. This was in line with the 3-month average

growth of 2.7% and below the 12-month average growth of

4.2%.

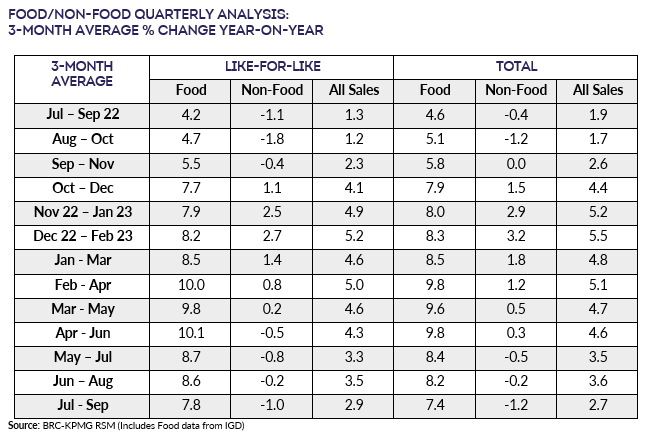

-

Food sales increased 7.4% on a Total basis

over the three months to September. This is below the 12-month

average growth of 8.4%. For the month of September, Food was in

growth year-on-year.

-

Non-Food sales decreased 1.2% on a Total basis

over the three-months to September. This is below the 12-month

average growth of 0.6%. For the month of September, Non-Food

was in decline year-on-year.

- Over the three months to September, In-store Non-Food

sales increased 0.3% on a Total basis since September

2022. This is below the 12-month average growth of 3.2%.

-

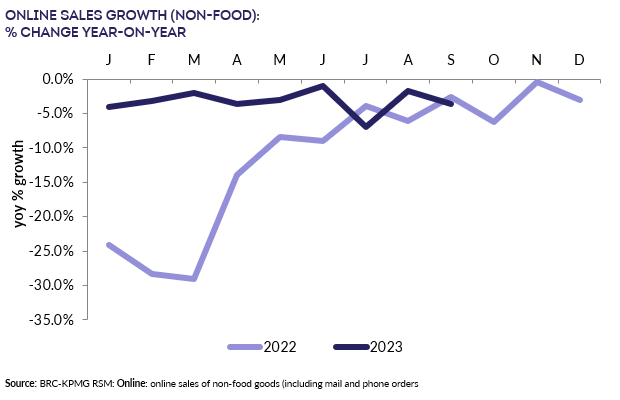

Online Non-Food sales decreased by 3.6% in

September, against a decline of 2.6% in September 2022. This

was shallower than the 3-month decline of 4.1% and deeper than

the 12-month decline of 3.2%.

- The proportion of Non-Food items bought online (penetration

rate) decreased to 34.9% in September from 35.1% in September

2022.

Helen Dickinson OBE, Chief Executive

of the British Retail Consortium, said:

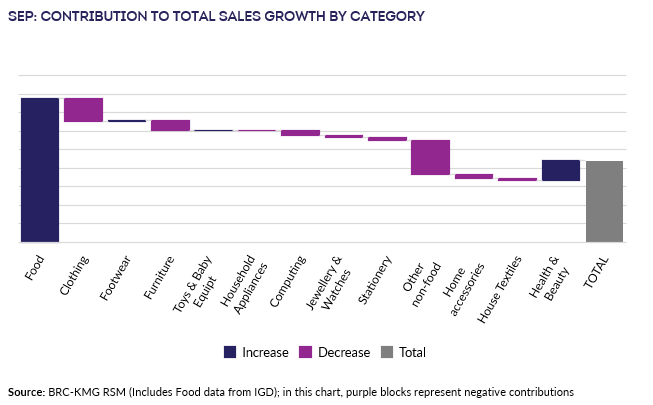

“Sales growth in September slowed as the high cost of living

continues to bear down on households. Big ticket items such as

furniture and electricals performed poorly as consumers limited

spending in the face of higher housing, rental and fuel costs.

The Indian summer also meant sales of autumnal clothing, knitwear

and coats, have yet to materialise.

“With sales volumes down, growth has been artificially boosted by

high inflation over the last two years. As inflation eases, so

too will longer-term sales growth prospects. The coming months

are crucial for retailers as they enter the “Golden Quarter” and

they’re investing heavily to support customers and bring prices

down. However, such efforts are challenged by the £400m increase

in business rates expected next year. The Chancellor should scrap

the rates rise in his upcoming Budget and enable retailers to

deliver more value for customers at such a critical time for the

economy.”

, UK Head of Retail,

KPMG

“Retail sales continued to limp along, with growth up just 2.7%

despite inflation falling in September.

“Food and drink, and health and beauty continue to be the

strongest performing categories on the high street, whilst a

growing number of categories including clothing, fell into

negative territory over September as the unseasonal warm weather

delayed trips to the shops to stock up on winter wardrobe

purchases. Online sales growth continued to fall, with just

health, beauty and jewellery recording positive sales growth.

September signals the 26th month of continuous online sales

decline and retailers will be hoping for a strong Black Friday in

order to turn the tide.

“With the warmer weather delaying household heating being

switched on, positive news around falling inflation and a hold on

rising interest rates, consumers will hopefully be feeling a bit

more confident as thoughts turn to Christmas shopping.

“After years of battling challenges, the resilience of the retail

sector has been dented and we are starting to see the gap between

the strongest and the weakest on the high street widen. The fight

for Christmas shoppers will be fierce this year, with promotions

likely to be earlier and abundant in a bid to loosen tight

household purse strings. Consumers will continue to seek out good

deals, with price driving purchasing decisions. This is

likely to be one of the most important golden quarters that we

have seen in years, as for some in the sector, it could very much

determine their future.”

Food & Drink sector performance | Sarah Bradbury,

CEO, IGD

“Food and drink sales grew in September, continuing the positive

momentum seen in August. Despite falling consistently for several

months, inflation is still significantly higher than recent

historical standards, and volumes remain down year-on-year.

Retailers are doing what they can to limit the impact of

inflation on shoppers, with many announcing further rounds of

price cuts and price freezes.

“Shopper confidence reached its highest level since December 2021

in September, as fewer shoppers felt they would be financially

worse off in the year ahead (35% vs 38% last month and 60% in

Sep’22). Trust in the food industry around price, availability

and quality rose as well, reflecting a general uplift in mood

with warm weather and falling inflation. However, 68% of shoppers

still expect food prices to rise in the next 12 months – with 16%

expecting them to become much more expensive.”

-ENDS-