Sales figures are not adjusted for inflation. Given that both the

August SPI (BRC) and July CPI (ONS) show inflation running at

higher than normal levels, the rise in sales masked a likely drop

in volumes once inflation is accounted for. Like-for-like data

has been moved from the bullets to the tables at the bottom.

Covering the four weeks 30 July – 26 August

2023

-

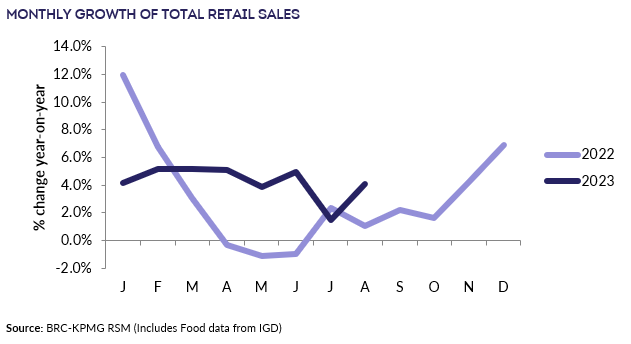

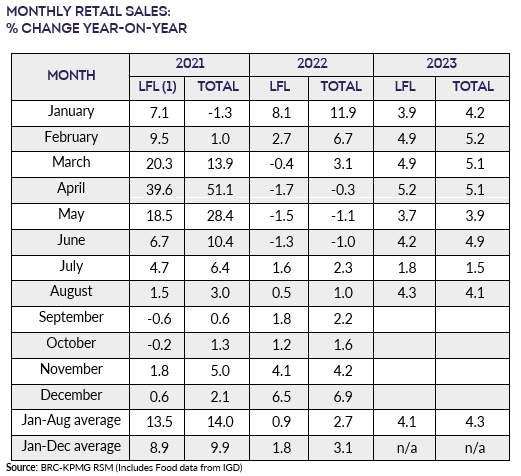

UK Total retail sales

increased by 4.1% in August, against a growth of 1.0% in August

2022. This was above the 3-month average growth of 3.6% and in

line with the 12-month average growth of 4.1%.

-

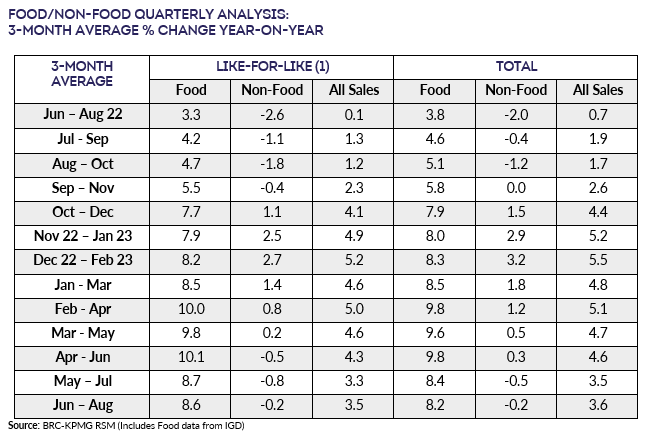

Food sales increased 8.2% on a Total basis

over the three months to August. This is above the 12-month

average growth of 8.0%. For the month of August, Food was in

growth year-on-year.

-

Non-Food sales decreased 0.2% on a Total basis

over the three-months to August. This is below the 12-month

average growth of 0.9%. For the month of August, Non-Food was

in growth year-on-year.

- Over the three months to August, In-store Non-Food

sales increased 1.3% on a Total basis since August 2022.

This is below the 12-month average growth of 3.6%.

-

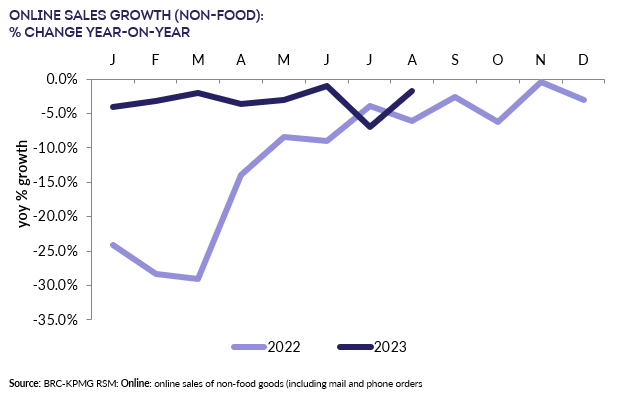

Online Non-Food sales decreased by 1.7% in

August, against a decline of 6.1% in August 2022. This was

shallower than the 3-month and 12-month declines of 3.1%.

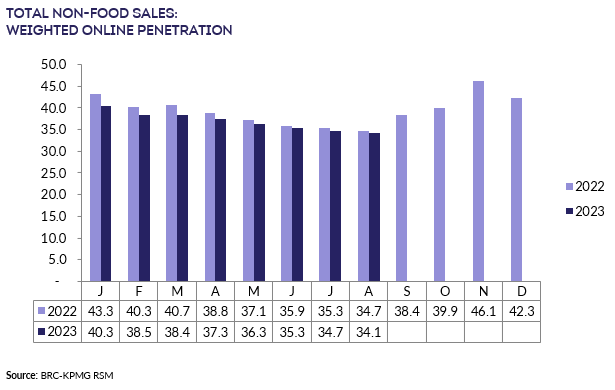

- The proportion of Non-Food items bought online (penetration

rate) decreased to 34.1% in August from 34.7% in August 2022.

Helen Dickinson OBE, Chief Executive of the British

Retail Consortium, said:

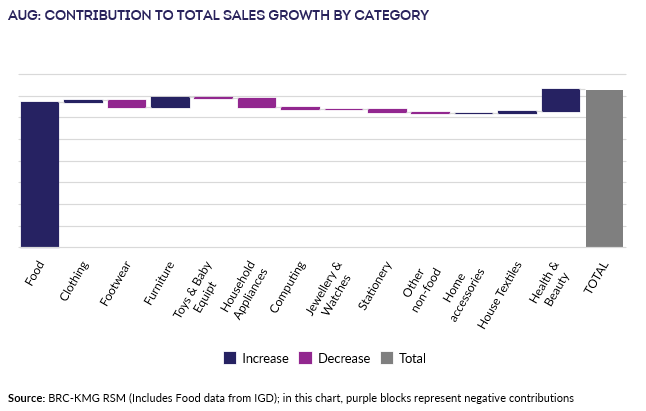

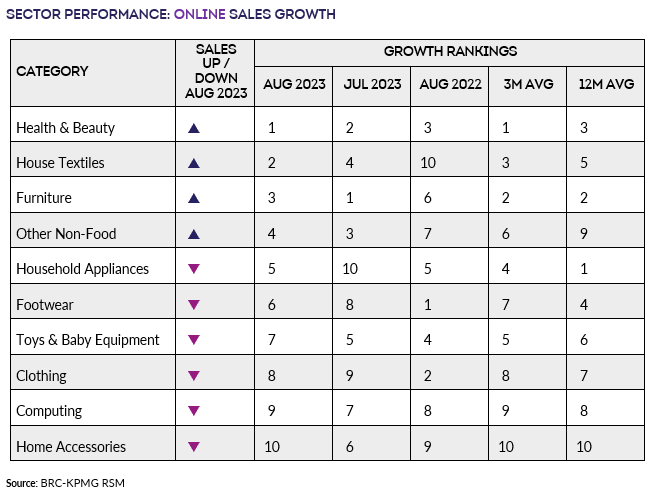

“Retail sales in August improved, particularly on July’s poor

performance. Sale of non-food products had their best month since

February, particularly for health and beauty products as

retailers continued to invest in new, exciting brands, and

customers splurged on self-care. The sales figures reflected the

improvement in consumer confidence in August, and retailers hope

this general upwards trend will carry on. Not all areas

benefitted, clothing and footwear saw weaker growth as families

held back spending on children’s uniforms and other

back-to-school goods until the last minute.

“Easing inflation will certainly be welcomed by consumers, but as

the rate of price rises falls, so will the extra spending needed

by consumers. As a result, sales growth may fall in the coming

months, even if volume growth does not. Furthermore, high

interest rates and high winter energy bills will put pressure on

many households to spend cautiously. Retailers are combatting

this through a clear focus on great value for consumers,

expanding budget ranges, and finding ways to cut costs where

possible.”

, UK Head of Retail,

KPMG

“August saw a bounce back in retail sales growth to 4.1%, which

will come as a relief for many retailers.

“Health, beauty and food and drink were the strongest performing

categories both on the high street and online, as consumers made

the most of brief spells of sunshine to enjoy the summer

holidays. Internet retailers continue to struggle as online sales

fell yet again in August, dropping by 3% year on year.

“As summer comes to an end, retailers will have their sights

firmly set on the most crucial period of trading as consumers get

ready for Christmas. Inflation levels are heading in the right

direction, albeit much more slowly than hoped, and savvy shoppers

will be Christmas bargain hunting much earlier this year, as

price continues to drive decisions and consumers seek out good

deals to stretch their budgets. With shoppers becoming more

calculated and aware of what they are getting for their money

than we have seen for a long time, retailers will have to fight

harder for every sale.

“Having survived the pandemic and continuing to battle through

the cost-of-living crisis, we are already starting to see the

resilience of the sector begin to fade and high street casualties

are starting to emerge. Maintaining consumer confidence as we

head into the golden quarter will be absolutely vital for some in

the sector, who will need a good Christmas in order to continue

trading in 2024.”

Food & Drink sector performance | Sarah Bradbury,

CEO, IGD

“Despite the disappointing summer weather, August saw food and

drink sales recovering some momentum that was lost in July. The

progress of the Lionesses in the World Cup brought cheer to

consumers and an excuse for get-togethers around game

times. However, inflation remains the dominant driver of

headline growth in the sector and, although lower now than the

peaks seen a few months ago, it remains high by historical

standards.

“Shopper sentiment was more muted in August, matching the

disappointing summer weather. IGD’s Shopper confidence Index

declined marginally, following recent gains. Shoppers remain

concerned about the relatively high food inflation. Fewer now

believe food prices will get cheaper in the next year (8% vs 11%

last month). Only 13% expect food prices to return to their 2021

level.”