BRC-SENSORMATIC IQ FOOTFALL MONITOR – AUGUST

2023

Sunless summer sinks

footfall

Covering the four weeks 30 July – 26

August 2023

According to BRC-Sensormatic IQ

data:

-

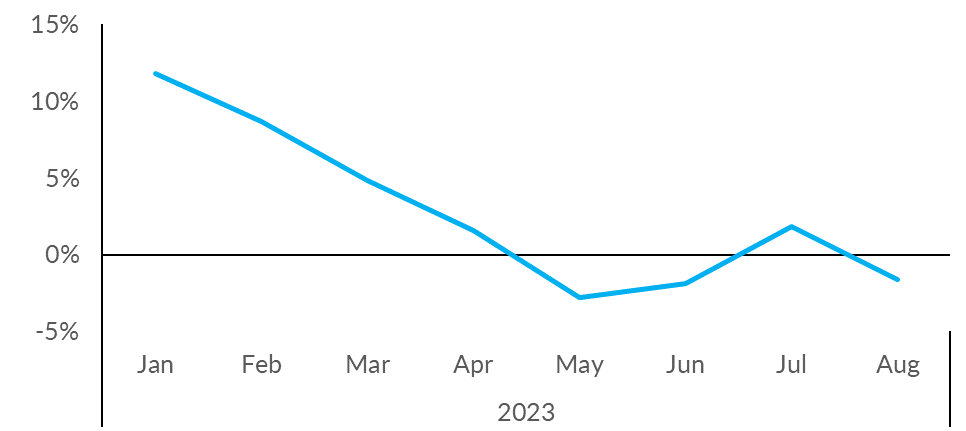

Total

UK footfall decreased by 1.6%

in August (YoY), down from +1.8% in July.

-

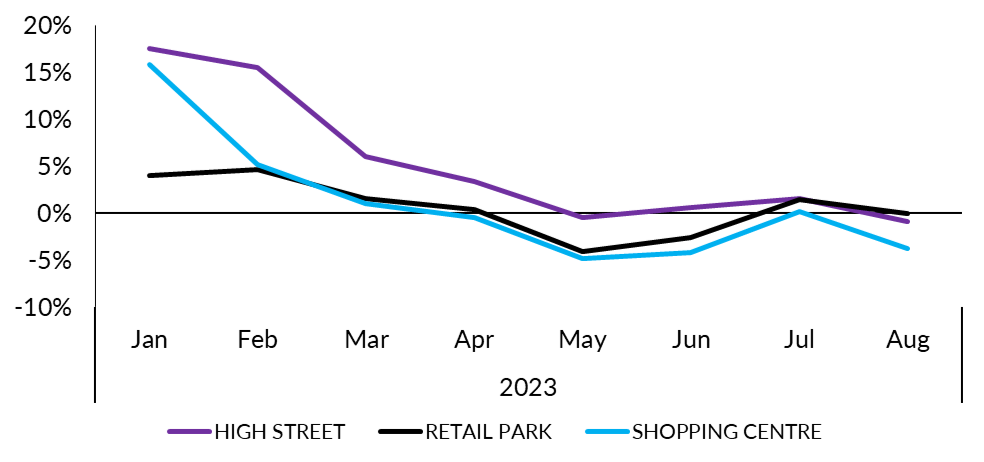

High

Street footfall decreased by

0.9% in August (YoY), down from +1.6% in July.

-

Retail Parks footfall

was unchanged at 0.0% in August (YoY),

down from +1.4% in July.

-

Shopping

Centre footfall decreased by

3.8% in August (YoY), down from +0.2% in July.

- Of the UK nations, Scotland saw a

YoY rise in footfall, showing an increase of +0.4%.

Conversely, England saw a YoY drop in

footfall, a decrease of 1.3%. This was followed

by Wales at -1.7%

and Northern Ireland at -4.7%.

Helen Dickinson, Chief Executive of the British Retail

Consortium, said:

“Footfall took a turn for the worse in August as the summer sun

failed to materialise. The impact was made worse when compared to

last year’s heatwave, where many shoppers rushed to the shops to

buy clothing, BBQs and other outdoor essentials. This month it

was shopping centres that took the biggest hit, while high

streets were also significantly down on last year.

“The rise in tourism, which returned to pre-Covid levels last

month, did not help key shopping destinations. Government should

re-introduce a tax-free shopping scheme to attract international

shoppers, who are currently choosing other destinations. Unless

action is taken, the UK remains the only European country without

a VAT-free shopping scheme scheme.”

Andy Sumpter, Retail Consultant EMEA for Sensormatic

Solutions, commented:

“An inclement August saw

overall footfall dip marginally year-on-year after rallying in

July, with dwindling shopper traffic not helped by nondescript

weather, as well as the continued consumer caution and

cost-of-living pressures that both shoppers – and retailers –

have become increasingly accustomed to. And while total

footfall was down, August showed some positive performance when

it came to destination shopping with some travel and tourism hub

cities, including Edinburgh, London, Liverpool and Manchester,

showing positive upticks from ambient footfall boosted by tourism

and school holiday staycations. Similarly, while our data

showed the number of store counts of shoppers to retail units

within shopping centres and retail parks dipped last month, the

number of visitors to those retail settings remained

positive. So, even if consumers are being more purposeful,

visiting fewer stores during each shopping trip, the opportunity

to benefit from that ambient footfall remains – the key will be

how retailers can tap into that opportunity to turn passing trade

into store visits and sales through meaningful store experiences

and a retail offer that speaks to value.”

MONTHLY TOTAL UK RETAIL FOOTFALL (% CHANGE

YOY)

UK FOOTFALL BY LOCATION (% CHANGE YOY)

TOTAL FOOTFALL BY NATION AND REGION

|

GROWTH RANK

|

NATION AND REGION

|

Aug-23

|

Jul-23

|

|

1

|

London

|

2.5%

|

3.5%

|

|

2

|

North East England

|

1.0%

|

4.3%

|

|

3

|

Scotland

|

0.4%

|

5.9%

|

|

4

|

England

|

-1.3%

|

1.8%

|

|

5

|

North West England

|

-1.6%

|

-0.3%

|

|

6

|

Wales

|

-1.7%

|

-0.1%

|

|

7

|

South West England

|

-2.0%

|

2.0%

|

|

8

|

South East England

|

-2.4%

|

2.3%

|

|

9

|

East Midlands

|

-4.0%

|

2.2%

|

|

10

|

West Midlands

|

-4.0%

|

-1.1%

|

|

11

|

Yorkshire and the Humber

|

-4.0%

|

1.0%

|

|

12

|

Northern Ireland

|

-4.7%

|

1.4%

|

|

13

|

East of England

|

-5.4%

|

0.0%

|

TOTAL FOOTFALL BY CITY

|

GROWTH RANK

|

CITY

|

Aug-23

|

Jul-23

|

|

1

|

Edinburgh

|

5.7%

|

12.8%

|

|

2

|

Liverpool

|

4.7%

|

5.5%

|

|

3

|

London

|

2.5%

|

3.5%

|

|

4

|

Manchester

|

1.1%

|

1.5%

|

|

5

|

Bristol

|

-0.3%

|

3.8%

|

|

6

|

Leeds

|

-1.0%

|

3.8%

|

|

7

|

Cardiff

|

-1.5%

|

-1.1%

|

|

8

|

Glasgow

|

-3.2%

|

1.6%

|

|

9

|

Nottingham

|

-5.4%

|

-0.5%

|

|

10

|

Birmingham

|

-5.4%

|

-1.4%

|

|

11

|

Belfast

|

-6.2%

|

-1.6%

|

Scots retail destinations see footfall rise and

outperform UK

Covering the four weeks 30 July – 26

August 2023

According to SRC-Sensormatic IQ data:

-

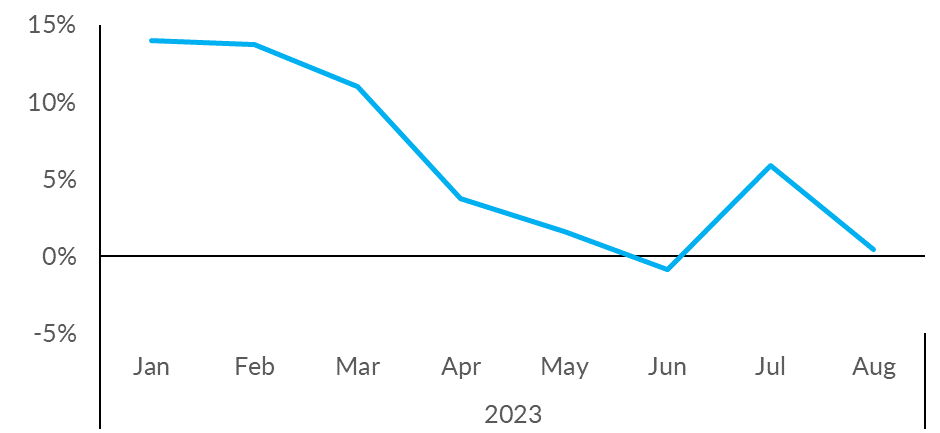

Scottish footfall increased by

0.4% in August (YoY), 5.5 percentage points worse than July.

This is better than the UK average decrease of 1.6% (YoY).

-

Shopping

Centre footfall increased by

3.1% in August (YoY) in Scotland, 1.2 percentage points worse

than July.

- In August, footfall

in Edinburgh increased by

5.7% (YoY),

while Glasgow decreased by

3.2% (YoY).

David Lonsdale, Director of the Scottish Retail

Consortium, said:

“Scottish footfall to retail destinations grew for the second

successive month in August, albeit there was a marked

deceleration in the growth rate. Scotland outperformed the UK

average and was one of only three out of thirteen parts of the UK

to witness any improvement at all last month. That said, Scottish

footfall is still an eighth down on pre-Covid levels.

“Shopping centres fared well, perhaps bolstered by return to

school preparations. Edinburgh was the top performing UK city in

the survey, aided by tourists and the festivals. Foot-traffic in

Glasgow dipped, albeit its recovery from the pandemic remains

marginally better than that of its near neighbour along the M8.

“The challenges for shops and our retail destinations aren’t all

in the rear-view mirror. Hybrid working remains prevalent in some

sectors and means a chunk of office workers are no longer

travelling into city centres as frequently. When shoppers do

visit the high street they are spending less on fewer items as

elevated levels of inflation, higher mortgage rates and taxes

continue to chisel away at household disposable incomes. That’s

why retailers are looking to policy makers – including the First

Minister’s Programme for Government next week – for measures will

lift consumers’ spirits, bring the energy and footfall back into

our larger economic hubs, and stem the remorseless rise in

government-inspired costs.”

Andy Sumpter, Retail Consultant EMEA for Sensormatic

Solutions, commented:

“Despite nondescript weather,

as well as the continued consumer caution and cost-of-living

pressures that both shoppers – and retailers – have become

increasingly accustomed to, August saw overall footfall remain

resilient, buoyed by positive performance from destination

shopping, with travel and tourism hubs, including Edinburgh,

seeing upticks from ambient footfall boosted by tourism and

school holiday staycations. And, while our data showed the

number of store counts of shoppers to retail units within

shopping centres and retail parks dipped last month, the number

of visitors to those retail settings remained positive. So,

even if consumers are being more purposeful, visiting fewer

stores during each shopping trip, the opportunity to benefit from

that ambient footfall remains – the key will be how retailers can

tap into that opportunity and turn passing trade into store

visits and sales through meaningful store experiences and a

retail offer that speaks to value.”

MONTHLY TOTAL SCOTTISH RETAIL FOOTFALL (% CHANGE

YoY)

UK FOOTFALL BY LOCATION (% CHANGE YoY)

TOTAL FOOTFALL BY NATION AND REGION

|

GROWTH RANK

|

NATION AND REGION

|

Aug-23

|

Jul-23

|

|

1

|

London

|

2.5%

|

3.5%

|

|

2

|

North East England

|

1.0%

|

4.3%

|

|

3

|

Scotland

|

0.4%

|

5.9%

|

|

4

|

England

|

-1.3%

|

1.8%

|

|

5

|

North West England

|

-1.6%

|

-0.3%

|

|

6

|

Wales

|

-1.7%

|

-0.1%

|

|

7

|

South West England

|

-2.0%

|

2.0%

|

|

8

|

South East England

|

-2.4%

|

2.3%

|

|

9

|

East Midlands

|

-4.0%

|

2.2%

|

|

10

|

West Midlands

|

-4.0%

|

-1.1%

|

|

11

|

Yorkshire and the Humber

|

-4.0%

|

1.0%

|

|

12

|

Northern Ireland

|

-4.7%

|

1.4%

|

|

13

|

East of England

|

-5.4%

|

0.0%

|

TOTAL FOOTFALL BY CITY

|

GROWTH RANK

|

CITY

|

Aug-23

|

Jul-23

|

|

1

|

Edinburgh

|

5.7%

|

12.8%

|

|

2

|

Liverpool

|

4.7%

|

5.5%

|

|

3

|

London

|

2.5%

|

3.5%

|

|

4

|

Manchester

|

1.1%

|

1.5%

|

|

5

|

Bristol

|

-0.3%

|

3.8%

|

|

6

|

Leeds

|

-1.0%

|

3.8%

|

|

7

|

Cardiff

|

-1.5%

|

-1.1%

|

|

8

|

Glasgow

|

-3.2%

|

1.6%

|

|

9

|

Nottingham

|

-5.4%

|

-0.5%

|

|

10

|

Birmingham

|

-5.4%

|

-1.4%

|

|

11

|

Belfast

|

-6.2%

|

-1.6%

|

WRC-SENSORMATIC IQ FOOTFALL MONITOR – AUGUST

2023

Footfall slides as summer fails to lift shopper

spirits

Covering the four weeks 30 July – 26

August 2023

According to WRC-Sensormatic IQ data:

-

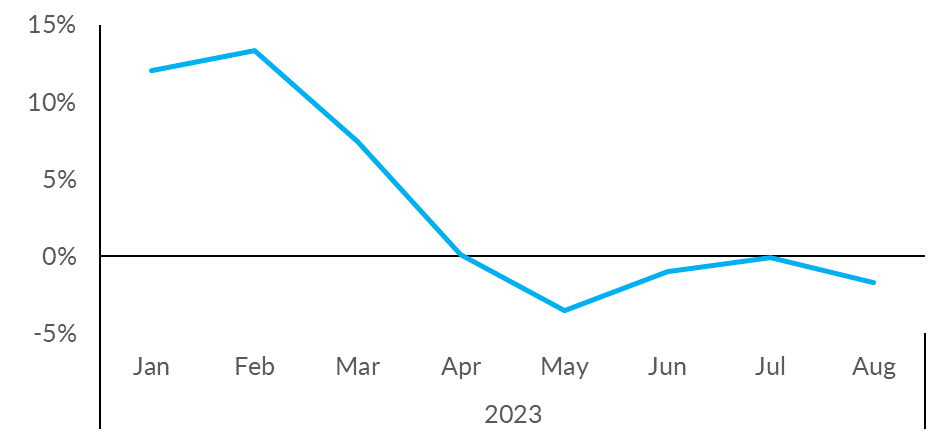

Welsh footfall decreased by

1.7% in August (YoY), down from -0.1% in July. This is worse

than the UK average decrease of 1.6% (YoY).

-

Shopping

Centre footfall decreased by

4.7% in August (YoY) in Wales, 1.1 percentage points worse than

July.

- In August, footfall

in Cardiff decreased by

1.5% (YoY), 0.4 percentage points worse than July.

Sara Jones, Head of the Welsh Retail Consortium,

said:

“Hopes of a scorching summer of sales for Welsh retailers fizzled

out following a slide in footfall. Shopper numbers in

August fell by almost 2 percentage points on the previous month

and remain an eighth down on pre Covid figures. Whilst retailers

will be hopeful that consumer confidence will improve over the

coming months as inflation eases, resulting in a hopeful bounce

in footfall, we are now entering mission critical territory as we

move closer to the ‘Golden Quarter’ of retail shopping in the

lead up to Christmas.

“Retailers are doing what they can to entice shoppers back to the

high street with fantastic offers and experiences, but it is

unquestionable that these destinations are transforming from a

retail focus to a broader mix of shops, leisure and housing. This

changing landscape needs to not only to be embraced, but to be

supported. With an eye watering projected hike in business rates

next April of £18million for Welsh retailers alone, we are

calling for a freeze on business rates to support our bricks and

mortar businesses which play such an important role in their

communities. A freeze on business rates would be good news for

retailers, for the high street ecosystem and for all of us who

value retail as a mainstay of our local economies.”

Andy Sumpter, Retail Consultant EMEA for Sensormatic

Solutions, commented:

“An inclement August saw

overall footfall dip marginally year-on-year after rallying in

July, with dwindling shopper traffic not helped by nondescript

weather, as well as the continued consumer caution and

cost-of-living pressures that both shoppers – and retailers –

have become increasingly accustomed to. And while total

footfall was down, August showed some positive performance when

it came to destination shopping with some travel and tourism hub

cities, including Edinburgh, London, Liverpool and Manchester,

showing positive upticks from ambient footfall boosted by tourism

and school holiday staycations. Similarly, while our data

showed the number of store counts of shoppers to retail units

within shopping centres and retail parks dipped last month, the

number of visitors to those retail settings remained

positive. So, even if consumers are being more purposeful,

visiting fewer stores during each shopping trip, the opportunity

to benefit from that ambient footfall remains – the key will be

how retailers can tap into that opportunity to turn passing trade

into store visits and sales through meaningful store experiences

and a retail offer that speaks to value.”

MONTHLY TOTAL WELSH RETAIL FOOTFALL (% CHANGE

YoY)

UK FOOTFALL BY LOCATION (% CHANGE YoY)

TOTAL FOOTFALL BY NATION AND REGION

|

GROWTH RANK

|

NATION AND REGION

|

Aug-23

|

Jul-23

|

|

1

|

London

|

2.5%

|

3.5%

|

|

2

|

North East England

|

1.0%

|

4.3%

|

|

3

|

Scotland

|

0.4%

|

5.9%

|

|

4

|

England

|

-1.3%

|

1.8%

|

|

5

|

North West England

|

-1.6%

|

-0.3%

|

|

6

|

Wales

|

-1.7%

|

-0.1%

|

|

7

|

South West England

|

-2.0%

|

2.0%

|

|

8

|

South East England

|

-2.4%

|

2.3%

|

|

9

|

East Midlands

|

-4.0%

|

2.2%

|

|

10

|

West Midlands

|

-4.0%

|

-1.1%

|

|

11

|

Yorkshire and the Humber

|

-4.0%

|

1.0%

|

|

12

|

Northern Ireland

|

-4.7%

|

1.4%

|

|

13

|

East of England

|

-5.4%

|

0.0%

|

TOTAL FOOTFALL BY CITY

|

GROWTH RANK

|

CITY

|

Aug-23

|

Jul-23

|

|

1

|

Edinburgh

|

5.7%

|

12.8%

|

|

2

|

Liverpool

|

4.7%

|

5.5%

|

|

3

|

London

|

2.5%

|

3.5%

|

|

4

|

Manchester

|

1.1%

|

1.5%

|

|

5

|

Bristol

|

-0.3%

|

3.8%

|

|

6

|

Leeds

|

-1.0%

|

3.8%

|

|

7

|

Cardiff

|

-1.5%

|

-1.1%

|

|

8

|

Glasgow

|

-3.2%

|

1.6%

|

|

9

|

Nottingham

|

-5.4%

|

-0.5%

|

|

10

|

Birmingham

|

-5.4%

|

-1.4%

|

|

11

|

Belfast

|

-6.2%

|

-1.6%

|