Responding to the BRC-NielsenIQ ‘Shop

Price Index’ (see below) which showed shop price inflation

continuing to ease, including a marked fall in the rate of food

prices inflation, Neil Johnston, Director of the Northern Ireland

Retail Consortium, commented:

“The overall fall in shop price

inflation is good news. Most welcome is the fact that food

inflation has come down by almost 2% since this time last year –

as food prices impact most heavily on the least well

off.

“We must not be complacent, however.

It is not inevitable that inflation will continue to decline.

Local decision making can help, however. What we need to see now

is leadership – including from politicians at Stormont and on our

local councils - to keep business costs down and to help

retailers bear down on inflation, ideally with a freeze to

business rates next Spring.

“The leaders of the main political

parties ought to be writing to the Secretary of State, Chris

Heaton Harris saying that, regardless of whether an Executive is

formed by the end of the year, they would support another freeze

in the regional rate for businesses.”

“Local councillors too should be

working to see how they can freeze their part of the business

rate. Last year while many councils continued to talk about

regenerating their towns and local economies, they actually

increased their part of the business rates by over 7%. Clearly,

this simply puts added pressure

on businesses and makes it

harder to keep down prices.”

BRC-NIELSENIQ SHOP PRICE INDEX – August 2023

Food inflation falling fast

Period Covered:

01 – 07 August

2023

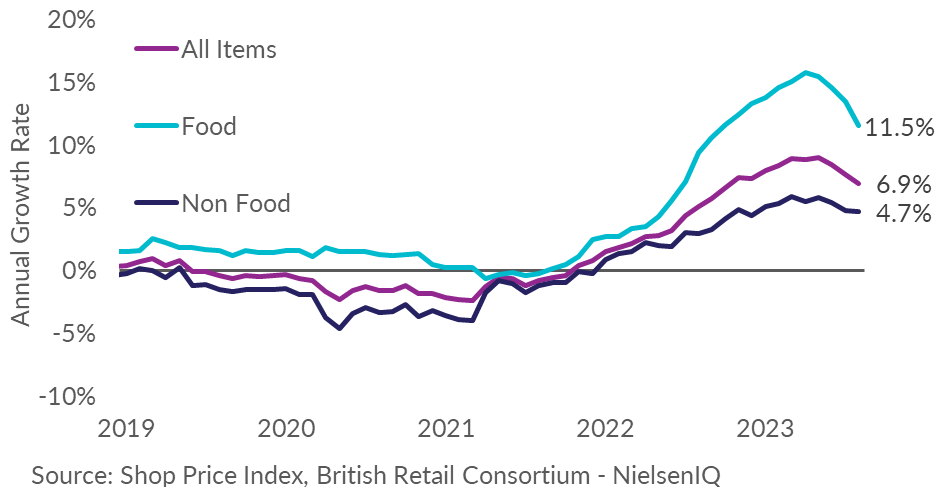

- Shop Price annual inflation decelerated further to 6.9% in

August, down from 7.6% in July. This is below the 3-month average

rate of 8.0%. Shop price growth is at its lowest since October

2022.

- Non-Food inflation remained unchanged at 4.7% in August. This

is below the 3-month average rate of 5.1%.

- Food inflation decelerated to 11.5% in August, down from

13.4% in July. This is below the 3-month average rate of 13.6%

and is the fourth consecutive deceleration in the food category.

Food inflation is at its lowest since September 2022.

- Fresh Food inflation slowed further in August, to 11.6%, down

from 14.3% in July. This is below the 3-month average rate of

13.8% and is at its lowest since August 2022.

- Ambient Food inflation decelerated to 11.3% in August, down

from 12.3% in July. This is below the 3-month average rate of

12.2% and is the lowest since January 2023.

|

|

OVERALL SPI

|

FOOD

|

NON-FOOD

|

|

% Change

|

On last year

|

On last month

|

On last year

|

On last month

|

On last year

|

On last month

|

|

Aug-23

|

6.9

|

0.5

|

11.5

|

0.6

|

4.7

|

0.4

|

|

Jul-23

|

7.6

|

-0.1

|

13.4

|

0.3

|

4.7

|

-0.2

|

Helen Dickinson, OBE, Chief Executive of the British

Retail Consortium, said:

“Better news for consumers as shop price inflation in August

eased to its lowest level since October 2022. This was driven by

falling food inflation, particularly for products such as meat,

potatoes and some cooking oils. These figures would have been

lower still had the Government not increased alcohol duties

earlier this month. Across Non-Food categories, toiletries and

cosmetics saw price growth ease as many key components became

cheaper, meanwhile inflation for clothing and footwear increased

as retailers unwound their extensive summer sales.

“While inflation is on course to continue to fall thanks to

retailers’ efforts, there are supply chain risks for retailers to

navigate. Russia’s withdrawal from the Black Sea Grain Initiative

and its targeting of Ukrainian grain facilities, as well as poor

harvests across Europe and beyond, could serve as potential

roadblocks to lower inflation. A potential £400m hike to business

rates bills from next April would certainly jeopardise efforts to

tackle inflation unless the Chancellor intervenes.”

Mike Watkins, Head of Retailer and Business Insight,

NielsenIQ, said:

“The unpredictable weather of recent weeks has dampened consumer

demand with some high street retailers increasing promotional

activity and food retailers continuing to extend price cuts, as

the inflationary pressure coming from supply chains continues to

lessen. Looking ahead, a NIQ survey shows that 60% of households

expect to be severely or moderately impacted by rising household

costs in the coming months so once back from summer holidays, we

expect consumers to remain cautious about discretionary spend

even as inflation decelerates.”