Covering the four weeks 2 – 29 July

2023

-

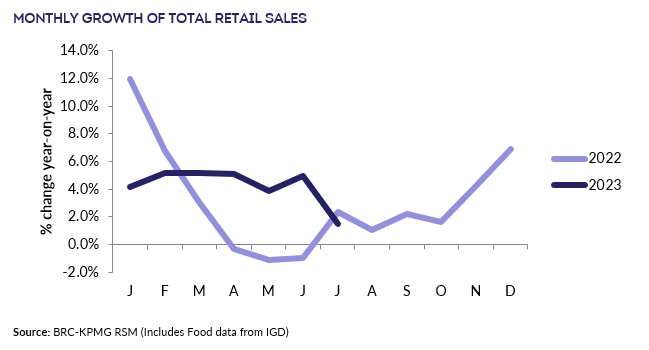

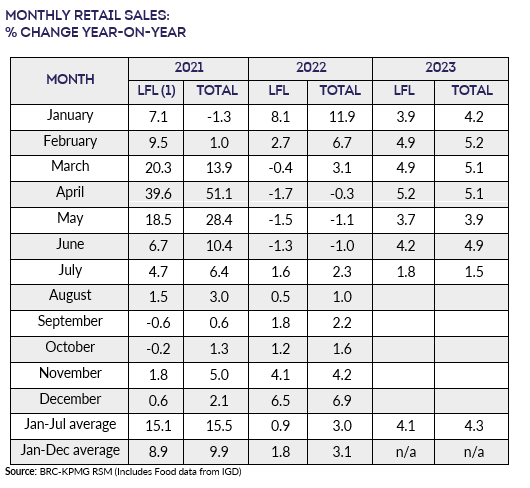

UK Total retail sales

increased by 1.5% in July, against a growth of 2.3% in July

2022. This is below the 3-month average growth of 3.5% and the

12-month average growth of 3.9%.

-

UK Like-for-like retail sales increased by

1.8% in July, against a growth of 1.6% in July 2022. This was

below the 3-month average growth of 3.3% and the 12-month

average growth of 3.6%.

-

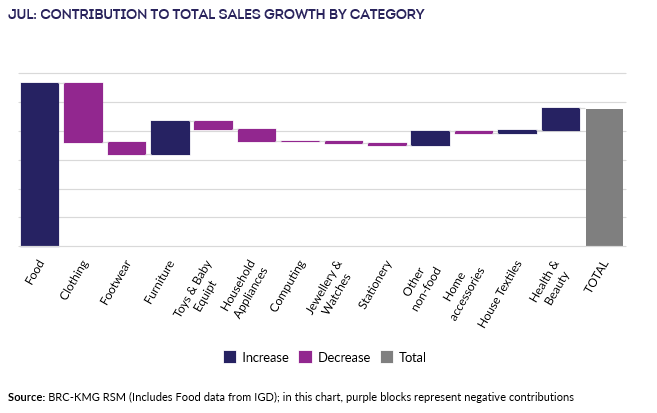

Food sales increased 8.4% on a Total basis and

8.7% on a Like-for-like basis over the three months to July.

This is above the 12-month Total average growth of 7.8%. For

the month of July, Food was in growth year-on-year.

-

Non-Food sales decreased 0.5% on a Total basis

and 0.8% on a like-for-like basis over the three-months to

July. This is below the 12-month Total average growth of 0.6%.

For the month of July, Non-Food was in decline

year-on-year.

- Over the three months to July, In-store Non-Food

sales increased 1.2% on a Total basis and 0.8% on a

Like-for-like basis since July 2022. This is below the Total

12-month average growth of 3.4%.

-

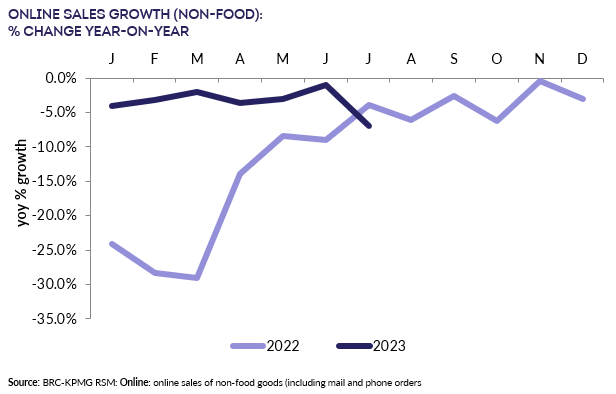

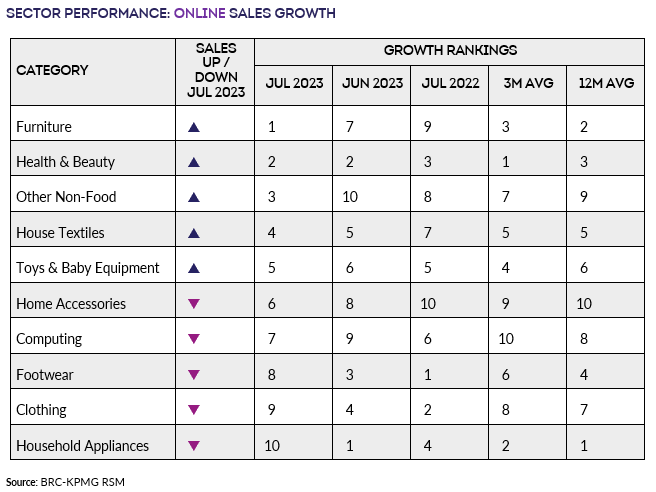

Online Non-Food sales decreased by 6.9% in

July, against a decline of 3.9% in July 2022. This is steeper

than the 3-month average decline of 3.4% and the 12-month

decline of 3.4%.

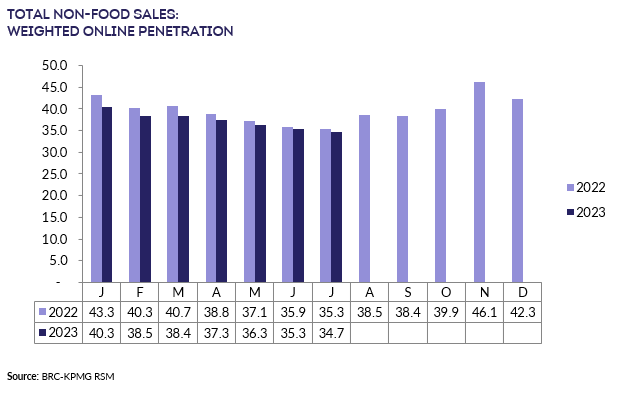

- The proportion of Non-Food items bought online (penetration

rate) decreased to 34.7% in July from 35.3% in July 2022.

Helen Dickinson OBE, Chief Executive

of the British Retail Consortium, said:

“The slowing pace of retail price inflation fed through into

slower sales this July. Spend was further depressed by the damp

weather, which did no favours to sales of clothing, and other

seasonal goods. Online spending was down again year on year as

the post covid trend back to stores continued, leading to the

lowest proportion of non-food sales online since the pandemic

began.

“While consumer confidence is generally improving, it remains

below longer term levels. And with last week’s rise in interest

rates pushing mortgage rates up ever higher, the Government must

get a handle on the economy, offering a solution to languishing

GDP growth in a way that supports both households and businesses.

Only by creating the economic conditions for future growth, will

we see a meaningful improvement in the outlook.”

, UK Head of Retail |

KPMG

“As the storm clouds came out, shoppers

retreated, with like for like sales growth a dismal 1.5% up in

July. Jewellery, food and drink and items for the home were the

best sellers on the high street, whilst the wet weather meant no

need to restock summer wardrobes, with all categories of clothing

falling into negative sales territory, in what is usually a busy

month for clothing retailers. Online sales continued to

slide, falling nearly 7% year on year, with just a handful of

categories such as furniture, health and beauty performing

well.

“We are starting to see a big rise in the number of promotions

that retailers are putting in place in order to get shoppers

through the door, as they battle to keep market share.

Price conscious consumers are shopping more carefully, more aware

of where bargains can be found and what they are getting for

their money – which is biting hard into retail margins and

profitability. UK consumers have been hugely resilient

throughout the cost-of-living crisis, but stubbornly high

inflation coupled with rapidly rising interest rates will test

their ability and willingness to keep on spending for the rest of

this year.

“Both consumers and retailers are finding that they are having to

get used to doing more with less as conditions remain incredibly

challenging."

Food & Drink sector performance | Sarah Bradbury, CEO

| IGD

“Food and drink sales continued to grow in

July, although the rate of growth was the lowest since January.

Sales growth was driven by inflation as volumes remained in

negative territory, in part due to the unseasonably wet weather,

especially compared to last July's heatwave.

“Although IGD’s Shopper Confidence Index increased for the fourth

month running, confidence remains low. Shoppers are feeling less

pessimistic about their personal finances, but they aren’t yet

feeling optimistic; fewer people are experiencing rising energy

bills (51% compared to 68% in Jul’22) and fewer shoppers expect

to be financially worse off in the year ahead (37% compared to

50% in Jul ’22). Furthermore, fewer shoppers are concerned about

food price rises with 68% expecting them to get more expensive in

the next 12 months compared to 89% last July.”

-ENDS-