BRC-SENSORMATIC IQ FOOTFALL MONITOR – JULY 2023

Covering the four weeks 02 July – 29

July 2023

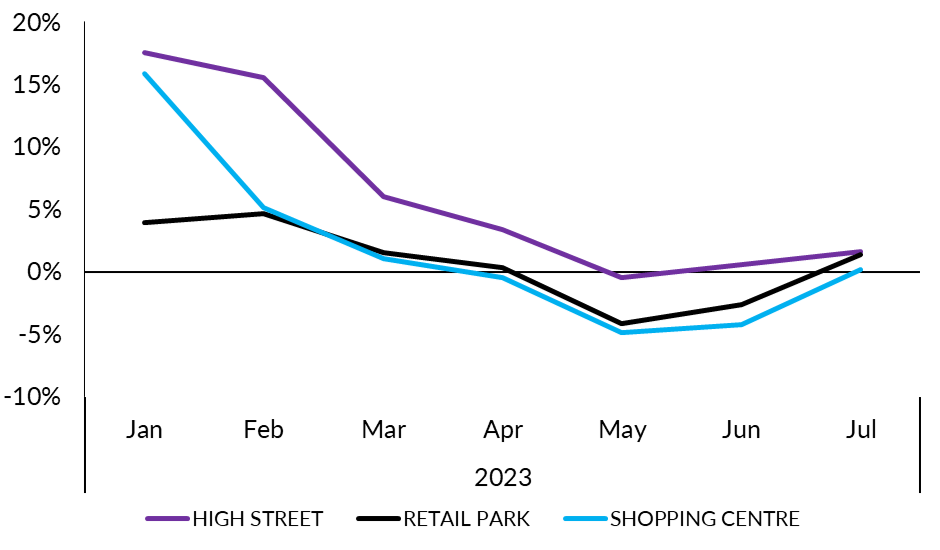

According to BRC-Sensormatic IQ data:

-

Total

UK footfall increased by

1.8% in July (YoY), up from -1.9% in June.

-

High

Street footfall increased by

1.6% in July (YoY), up from 0.6% in June.

-

Retail Parks saw

footfall increase by +1.4% in July

(YoY), up from -2.6% in June.

-

Shopping

Centre footfall increased by

0.2% in July (YoY), up from -4.2% in June.

- Footfall at other

retail locations increased by

8.6%. This was driven by increases in outlet sites.

- Of the UK nations, Scotland saw

the highest YoY increase in footfall with an

improvement of +5.9%, followed by England with +1.8% and Northern

Ireland with +1.4%. Wales saw a YoY decrease of -0.1%.

Helen Dickinson, Chief Executive of the British Retail

Consortium, said:

"July saw modest growth in footfall numbers in all locations

across most major cities in the UK, with Scotland and the

Northeast leading the way. The rainy start to the summer holidays

drove many people off the streets and into the shops, in contrast

to last year's heatwave, which kept people outside in the sun.

“The recovery in international tourism continues to drive shopper

numbers up in major cities. The Government should capitalise on

this by reintroducing a tax-free shopping scheme, as exists in

all other European Union countries. This would encourage more

visitors and stimulate more spending, boosting economic growth

and employment.”

Andy Sumpter, Retail Consultant EMEA for Sensormatic

Solutions, commented:

“Footfall saw a bounce back

into positive figures in July, reversing the slowdown experienced

in May and June. While retailers will welcome the uptick in

shopper traffic, it will be with a sense of practical

positivity. Many will be mindful they continue to serve a

cost-of-living consumer, who remains cautious - and may well

become more so with the prospect of further interest rates

threatening spending power in the mid- to long-term.

Indeed, our data shows that much of the footfall recovery in July

was shored up by strong performance in outlet retail, as shoppers

turn to discount formats to make spend go further. And this

is putting further pressure on retailers, already shouldering the

burden of growing price sensitivity, to turn to discounting to

drive demand. Even in the context of rising price

sensitivity, discounting remains just one of many levers

retailers can pull. By doubling down on value-driven but

experience-led propositions, retailers can build on the store’s

revival as the shopping channel of choice.”

MONTHLY TOTAL UK RETAIL FOOTFALL (% CHANGE

YOY)

UK FOOTFALL BY LOCATION (% CHANGE YOY)

TOTAL FOOTFALL BY NATION AND

REGION

|

GROWTH RANK

|

NATION AND REGION

|

Jul-23

|

Jun-23

|

|

1

|

Scotland

|

5.9%

|

-0.9%

|

|

2

|

North East England

|

4.3%

|

-5.6%

|

|

3

|

London

|

3.5%

|

0.6%

|

|

4

|

South East England

|

2.3%

|

-1.1%

|

|

5

|

East Midlands

|

2.2%

|

-4.7%

|

|

6

|

South West England

|

2.0%

|

-2.7%

|

|

7

|

England

|

1.8%

|

-1.9%

|

|

8

|

Northern Ireland

|

1.4%

|

-3.7%

|

|

9

|

Yorkshire and the Humber

|

1.0%

|

-4.2%

|

|

10

|

East of England

|

0.0%

|

-4.0%

|

|

11

|

Wales

|

-0.1%

|

-1.0%

|

|

12

|

North West England

|

-0.3%

|

-2.3%

|

|

13

|

West Midlands

|

-1.1%

|

-2.4%

|

TOTAL FOOTFALL BY CITY

|

GROWTH RANK

|

CITY

|

Jul-23

|

Jun-23

|

|

1

|

Edinburgh

|

12.8%

|

4.7%

|

|

2

|

Liverpool

|

5.5%

|

-3.0%

|

|

3

|

Bristol

|

3.8%

|

-2.6%

|

|

4

|

Leeds

|

3.8%

|

-1.3%

|

|

5

|

London

|

3.5%

|

0.6%

|

|

6

|

Glasgow

|

1.6%

|

-7.2%

|

|

7

|

Manchester

|

1.5%

|

-1.9%

|

|

8

|

Nottingham

|

-0.5%

|

-5.9%

|

|

9

|

Cardiff

|

-1.1%

|

0.0%

|

|

10

|

Birmingham

|

-1.4%

|

-5.2%

|

|

11

|

Belfast

|

-1.6%

|

-6.6%

|