BRC-KPMG retail sales monitor – APRIL 2023

Sales figures are not adjusted for inflation. Given that both the

April SPI (BRC) and March CPI (ONS) show inflation running at

historically record levels, the rise in sales masked a much

larger drop in volumes once inflation is accounted for.

Covering the four weeks 2 – 29 April

2023

-

UK Total

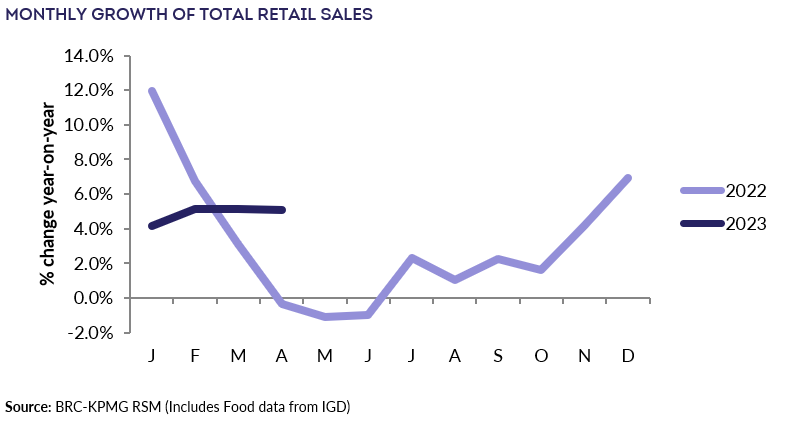

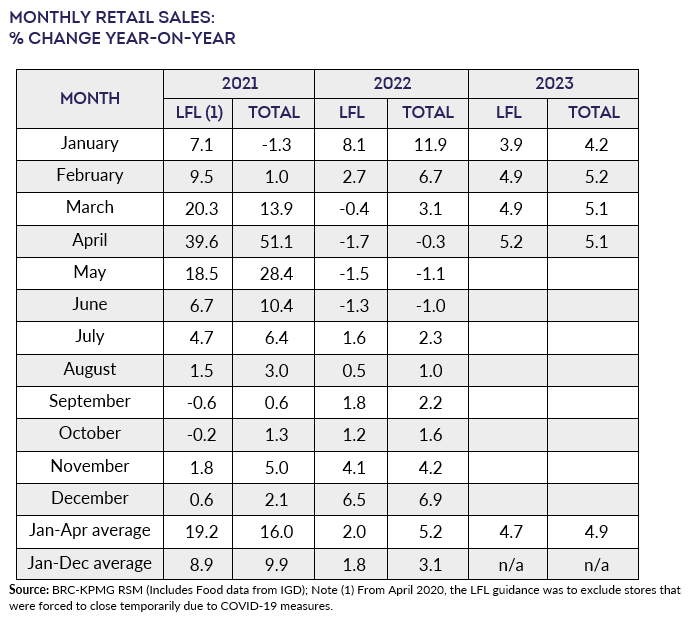

retail sales increased by

5.1% in April, against a decline of 0.3% in April 2022. This is

in line with the 3-month average growth of 5.1% and above the

12-month average growth of 3.0%.

-

UK Like-for-like retail sales increased

by 5.2% in April, against a decline of 1.7% in April 2022. This

was above the 3-month average growth of 5.0% and the 12-month

average growth of 2.7%.

-

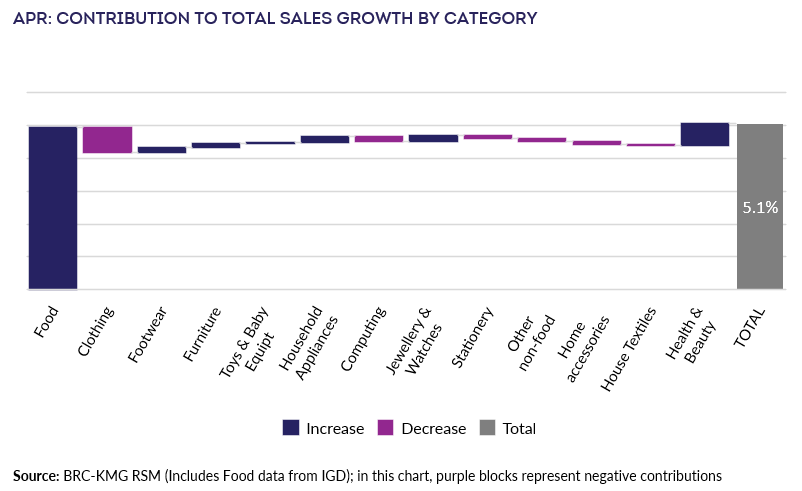

Food sales increased 9.8% on a Total

basis and 10.0% on a Like-for-like basis over the three months

to April. This is above the 12-month Total average growth of

6.3%. For the month of April, Food was in growth year-on-year.

-

Non-Food sales increased 1.2% on a Total

basis and 0.8% on a like-for-like basis over the three-months

to April. This is above the 12-month Total average growth of

0.2%. For the month of April, Non-Food was in growth

year-on-year.

- Over the three months to April, In-store

Non-Food sales increased 3.9% on a Total basis and

3.3% on a Like-for-like basis since April 2022. This is above the

Total 12-month average growth of 3.6%.

-

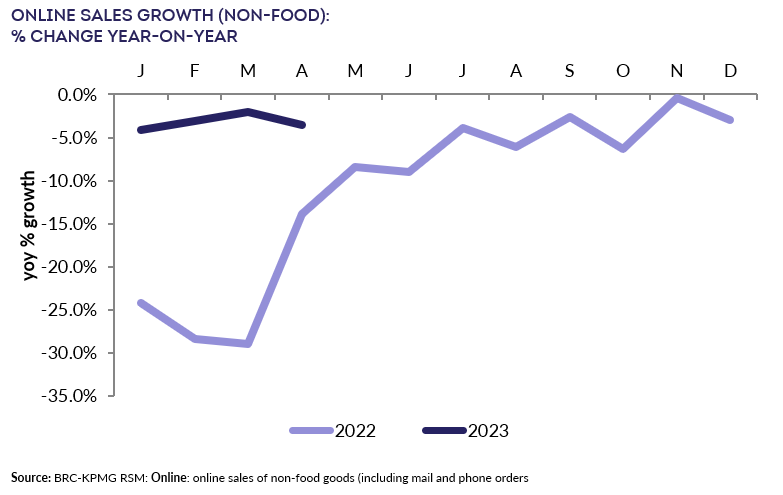

Online Non-Food sales decreased by 3.6%

in April, against a decline of 13.9% in April 2022. This is

steeper than the 3-month average decline of 2.9% and shallower

than the 12-month decline of 4.4%.

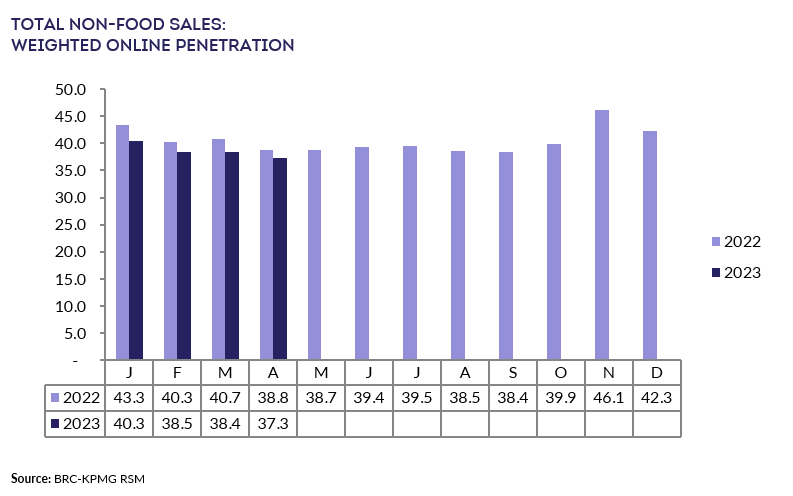

- The proportion of Non-Food items bought online (penetration

rate) decreased to 37.3% in April from 38.8% in April 2022.

Helen Dickinson OBE, Chief Executive | British Retail

Consortium

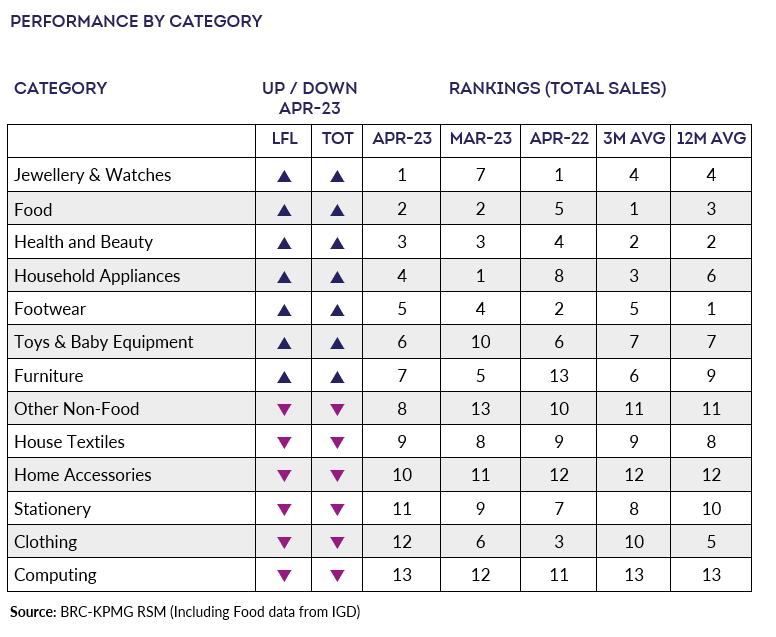

“While retail sales grew in April, overall

inflation meant volumes were down for both food and non-food as

customers continued to adjust spending habits. Clothing sales

underperformed as the poor weather left customers thinking twice

before decking out their summer wardrobe. Meanwhile, a boost to

overseas tourism over Easter helped jewellery, watches and

cosmetics.

“Retailers hope sales will improve over the warmer summer months,

especially as consumer confidence stabilises and inflation begins

to ease. However, they continue to face huge cost pressures from

a tight labour market, high energy prices, and other rising input

costs, with many retailers reporting lower profits this year as a

result. Government needs to ensure that any additional regulatory

cost burdens are kept to a minimum as these add to inflation.”

, UK Head of

Retail | KPMG

“Retail

sales held steady in April with 5% growth on last year, but

against a background of higher inflation year-on-year, masking

how much is actually healthy growth for the sector.

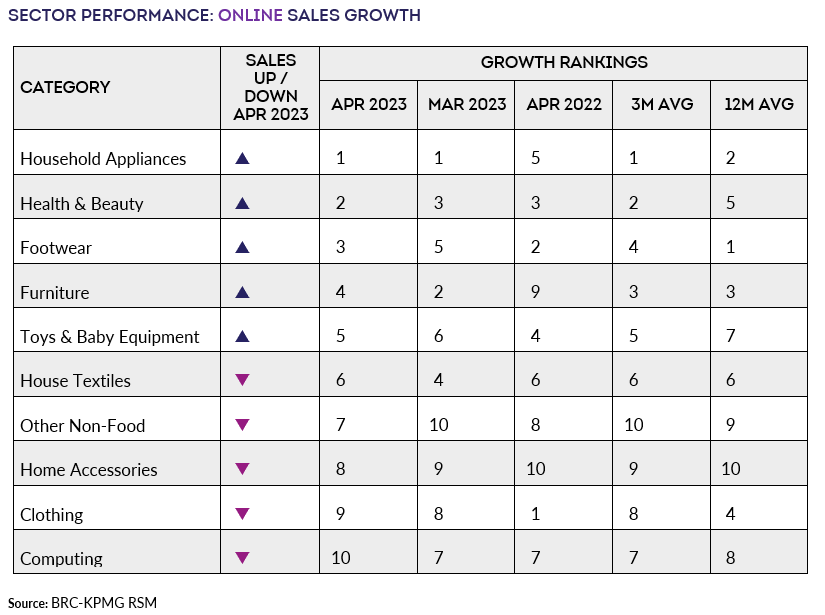

“It was a mixed bag for the high street, with sales of footwear,

food and jewellery performing strongly whilst more categories

slipped into negative territory as clothing and computing

continued to witness declining sales. Online retailers continued

to feel the pressure in April, with both sales growth and

penetration rates falling as the market rebalances after the

pandemic and consumers choose to bargain hunt in store.

“Consumer demand has so far been fairly resilient to the twin

drags of high inflation and high interest rates, but as

government energy support comes to an end for many, savings start

to dwindle and other household bills rise, it is likely that the

next few months will continue to be challenging as the consumer

tank empties. Much hinges on whether soaring food inflation

can be brought under control enough to allow consumers to

comfortably start spending again on non-essential items.

“Retailers will be hoping that the Coronation, coupled with a

month full of bank holidays and inflation levels starting to head

in the right direction, will boost consumer confidence

significantly enough to start to see real, profitable growth.”

Food & Drink sector performance | Susan Barratt, CEO

| IGD

“Food and drink sales in April continued the same trajectory seen

in recent months; volume sales were negative and value sales were

positive, driven by ongoing inflation. In response, retailers

have been stepping up their support to shoppers, with further

high-profile innovation and investment in loyalty schemes in

April, providing access to better prices.

“Despite the continued doom and gloom, IGD’s Shopper Confidence

Index improved a little in April. Trust in the food and consumer

goods industry saw a notable improvement, especially around

availability, with 65% trusting the industry to maintain good

availability compared to 58% the previous month. Despite rising

costs, our data shows shoppers continue to prioritise health and

sustainability. Some 87% of shoppers say they are trying to eat

more healthily (88% April ‘22), and 79% claiming the impact on

the environment was important to them when choosing what food or

grocery product to buy (80% April ‘22).”