-

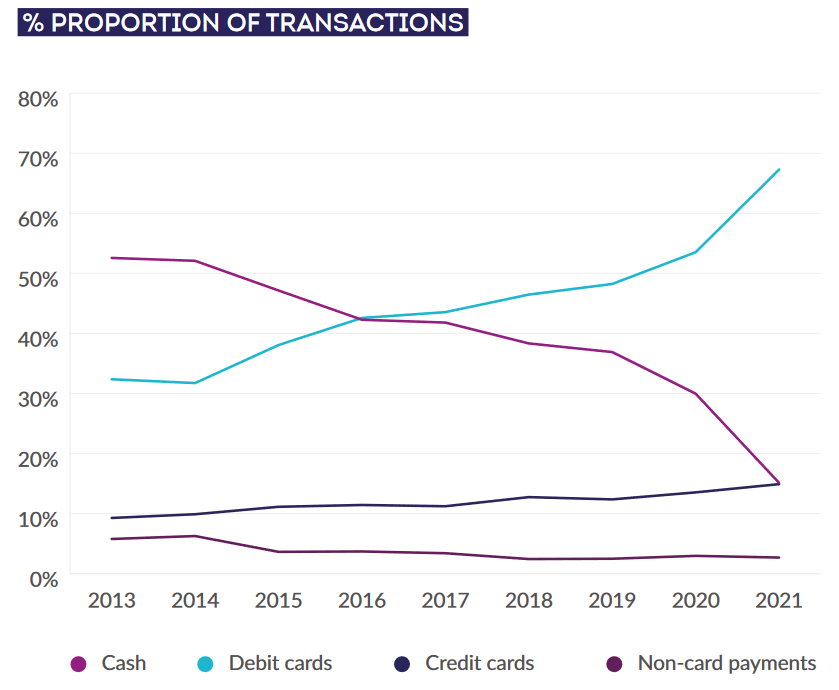

The pandemic changed the way we pay, with cash

accounting for just 15% of all transactions in 2021

-

90% of retail spending, and 82% of transactions, used

debit or credit card

-

Retailers spent £1.3bn to accept payments from

customers in 2021

Today, the British Retail Consortium (BRC) published its latest

annual Payments Survey. The report

reveals that in 2021, as stores closed for lockdowns and the

public was advised to use contactless payments, cash usage fell

to just 15% of all transactions (down from 30% in 2020), while

82% were made on credit or debit cards (up from 67% in 2020).

More than four-in-five card transactions were made using debit

cards, with the rest made up of credit and charge cards.

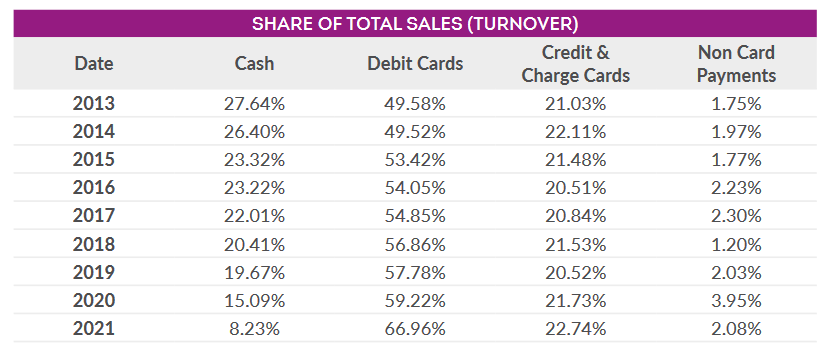

As a proportion of total money spent, cash accounted for just 8%

of consumer spend (down from 15%), while credit cards rose

slightly to 23%, and debit cards rose significantly to 67% (up

from 59% in 2020).

The rise in the use of card payments in part reflects the

increase in online shopping in 2021, when 48.6% of non-food items

were purchased online. This figure has fallen to 39.9% in the

first 11 months of 2022, as more people returned to the high

street as the pandemic eased. As a result, it remains to be seen

whether this shift to card payments will stick.

Cash remains vital for many people, particularly vulnerable

groups who do not have access to other payment methods. However,

the decline in cash has made it harder for many firms to use cash

efficiently – increasing the costs associated with handling

physical money. Government will need to look at solutions to

ensure it remains a viable payment option for consumers.

While card usage soared, so did the costs associated with

accepting these payments. Retailers incurred costs of £1.3

billion just to accept card payments from customers in 2021.

Debit cards, which accounted for the majority of transactions,

saw scheme fees rise by 28% compared to 2020, and total Merchant

Service charges increased by 12%. This translated into an

additional £141 million in costs imposed by card firms onto

retailers just to process debit card transactions.

Amidst a backdrop of mounting costs from rising

energy prices, rising commodity prices, rising transport costs, a

tight labour market, and other supply chain disruption, these

excessive card fees add further cost pressures to retailers.

The BRC, along with other business groups, have long been calling

for intervention on anti-competitive practices in card payments

in order to protect British businesses. The following actions

must be urgently considered:

-

Stop card fees rising: While the Payments

Systems Regulator undergoes their lengthy market reviews into

card fees, they must enact temporary interventions to stop card

fees rising during this period.

-

Remove interchange fees: In 2020, the UK

Supreme Court ruled that card firm interchange fees were

unlawful, but these are yet to be abolished.

-

Treasury Review: We call on the Treasury to

conduct its own review into the cost of accepting cards

Hannah Regan, Payments Policy Advisor, British Retail

Consortium said:

“With the public in and out of lockdown and cash usage

discouraged last year, over 90% of retail spending used debit or

credit card. With card usage soaring, already hard-pressed

retailers had to pay huge sums to accept these payments. We need

urgent intervention from the Payments Systems Regulator and the

Treasury to stop card schemes from abusing their dominant market

position.”

-ENDS-

Notes:

- Data for the BRC Payments Survey was gathered in 2022 and

covers the 2021 calendar year. Retailers participating in the

survey accounted for 40% of all UK retail annual sales turnover.

- Download the BRC Payments Survey 2022 here