Sales figures are not adjusted for inflation. Given that both the

September SPI (BRC) and August CPI (ONS) show inflation running

at historically high levels, a portion of the sales growth will

be a reflection of rising prices rather than increased volumes.

Covering the five weeks 28 August – 1 October

2022

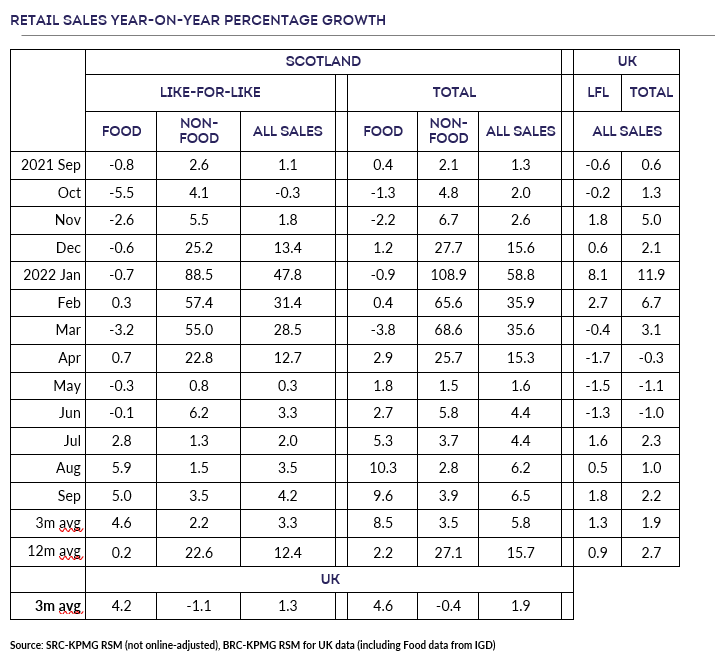

- Total sales in Scotland increased by 6.5% compared with

September 2021, when they had grown 1.3%. This was above the

3-month average increase of 5.8% and below the 12-month average

growth of 15.7%. Adjusted for inflation, the year-on-year change

was 0.8%.

- Scottish sales increased by 4.2% on a Like-for-like basis

compared with September 2021, when they had increased by 1.1%.

This is above the 3-month average increase of 3.3% and below the

12-month average growth of 12.4%.

- Total Food sales increased by 9.6% versus September 2021,

when they had increased by 0.4%. September was above the 3-month

average growth of 8.5% and the 12-month average growth of 2.2%.

The 3-month average was above the UK level of 4.6%.

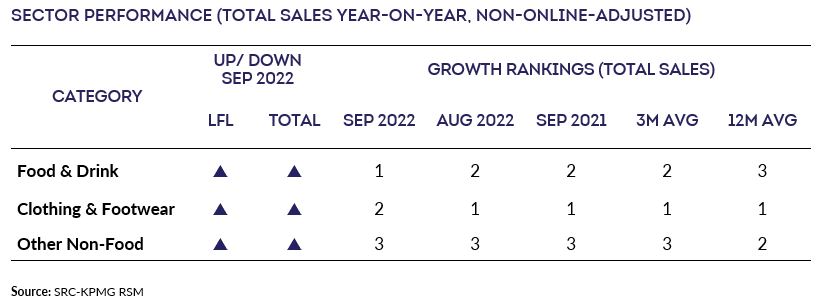

- Total Non-Food sales increased by 3.9% in September compared

with September 2021, when they had increased by 2.1%. This was

above the 3-month average increase of 3.5% and below the 12-month

average of 27.1%.

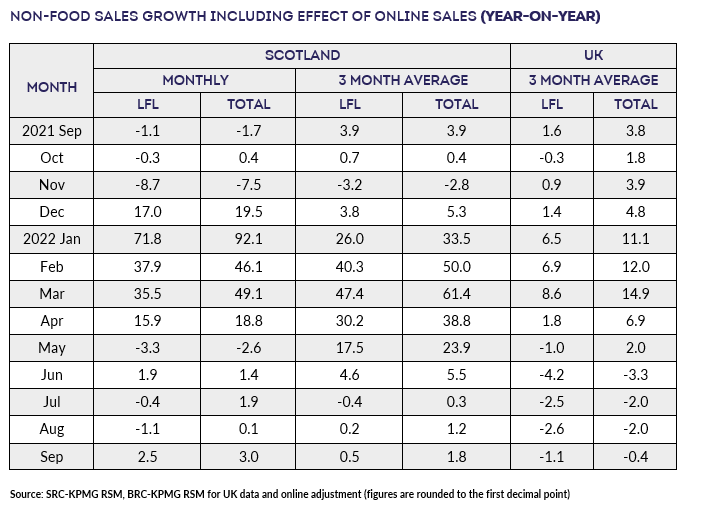

- Adjusted for the estimated effect of Online sales, Total

Non-Food sales increased by 3.0% in September versus September

2021, when they had decreased by 1.7%. This is above the 3-month

average growth of 1.8% and below the 12-month average of 18.5%.

Ewan MacDonald-Russell, Deputy Head | Scottish Retail

Consortium

“Scottish sales showed a sliver of growth in September, with a

real terms rise of 0.8 percent. Nonetheless, there are clear

signs customers are battening down the hatches ahead of the

expected winter costs crunch. Food sales fell in real terms as

customers cut back on the volume of goods. With food inflation

now outpacing sales even grocery retailers are feeling the

pressure as customers focus on essential items.

“Non-food sales were dominated by consumers looking for ways to

reduce their energy bills. Duvets, blankets, and air fryers all

did well as customers look to cut costs and prepare for

winter. These are not propitious signs for retailers as

they enter the golden trading quarter. With customers focusing on

essentials, it will be a real challenge to encourage shoppers to

splash out on Christmas gifts. Government need to keep a

watchful eye on this and be prepared to take action in upcoming

fiscal announcements to support retailers facing into the teeth

of intense cost challenges. “

, Partner, UK Head of

Retail | KPMG

“Despite Scottish retail sales growing

in September, high levels of inflation wiped out signs of real

terms growth, and unfortunately, tougher times are ahead.

Consumers were more cautious last month, avoiding large ticket

items as many households prepared for higher energy costs through

the winter, evidenced by a spike in warm clothes purchases during

September.

“With interest rates, inflation, labour, energy and cost of goods

continuing to climb, retailers are heading into one of the most

challenging Christmas shopping periods they have had to deal with

in years. Consumer confidence remains low, and retailers

are having to tread a very fine line between protecting their own

margins and further denting confidence by passing on price

rises. A laser focus on their own costs and efficiencies in

order to remain price competitive this festive season will be

essential. As consumers focus on getting value for money

through switching to own brand items and seeking out discounts,

getting pricing and promotional activity right could be the

difference between a successful or dismal Christmas for retailers

this year.”