Sales figures are not adjusted for inflation. Given that both the

July SPI (BRC) and June CPI (ONS) show inflation running at

historically high levels, the small rise in sales masked a much

larger drop in volumes once inflation is accounted for.

Covering the four weeks 3 - 30 July

2022

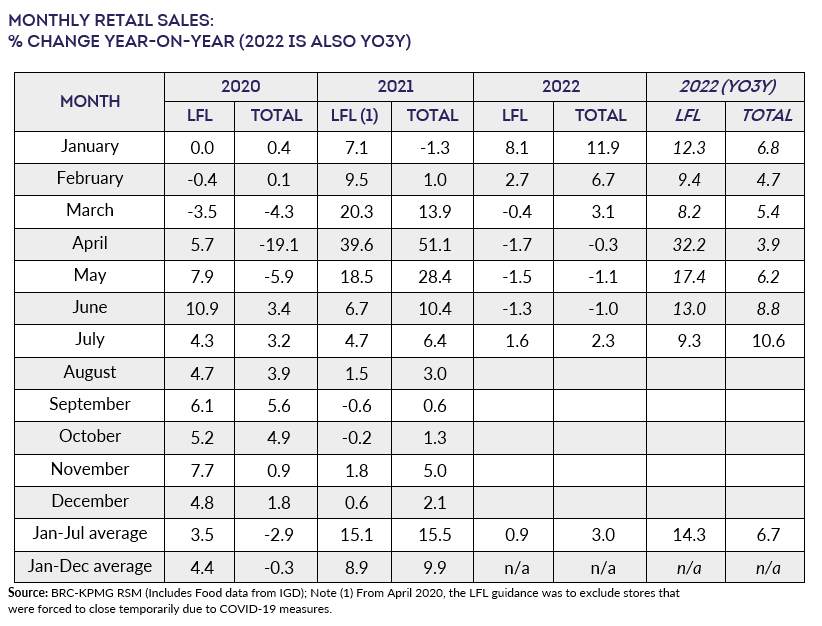

- On a Total basis, sales increased by 2.3% in July, against an

increase of 6.4% in July 2021. This is below the 3-month average

of 0.0% and the 12-month average growth of 2.7%.

- UK retail sales increased 1.6% on a Like-for-like basis from

July 2021, when they had increased 4.7%. This was above the

3-month average decline of 0.5% and below the 12-month average

growth of 0.8%.

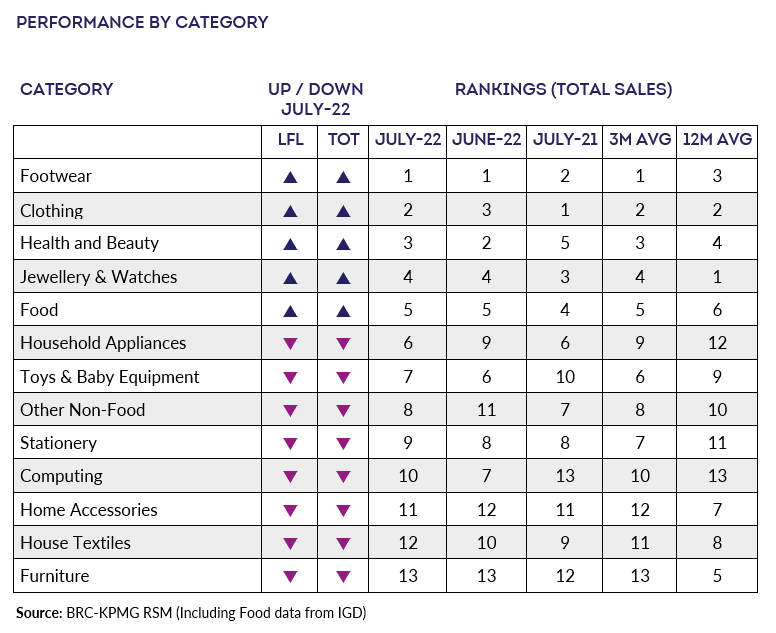

- Over the three months to July, Food sales increased 2.3% on a

Total basis and 1.8% on a Like-for-like basis. This is above the

12-month Total average growth of 0.6%. For the month of July,

Food was in growth year-on-year.

- Over the three-months to July, Non-Food retail sales

decreased by 2.0% on a Total basis and 2.5% on a like-for-like

basis. This is below the 12-month Total average growth of 4.5%.

For the month of July, Non-Food was in growth year-on-year.

- Over the three months to July, In-Store sales of Non-Food

items increased 2.0% on a Total basis and 1.2% on a Like-for-like

basis since July 2021. This is below the 12-month growth of

34.4%.

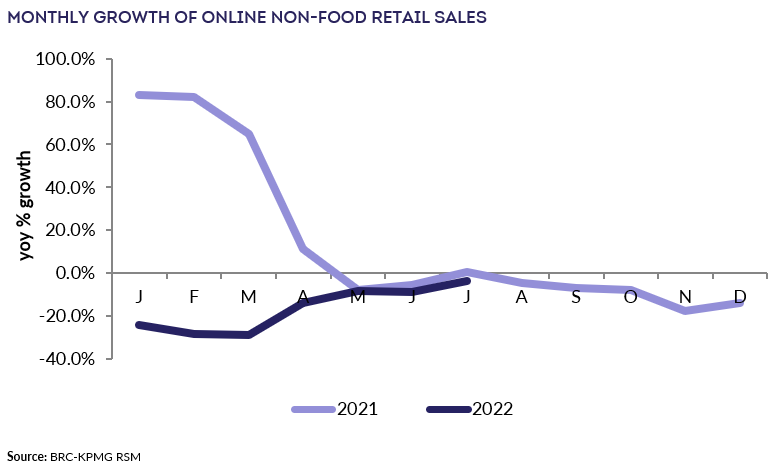

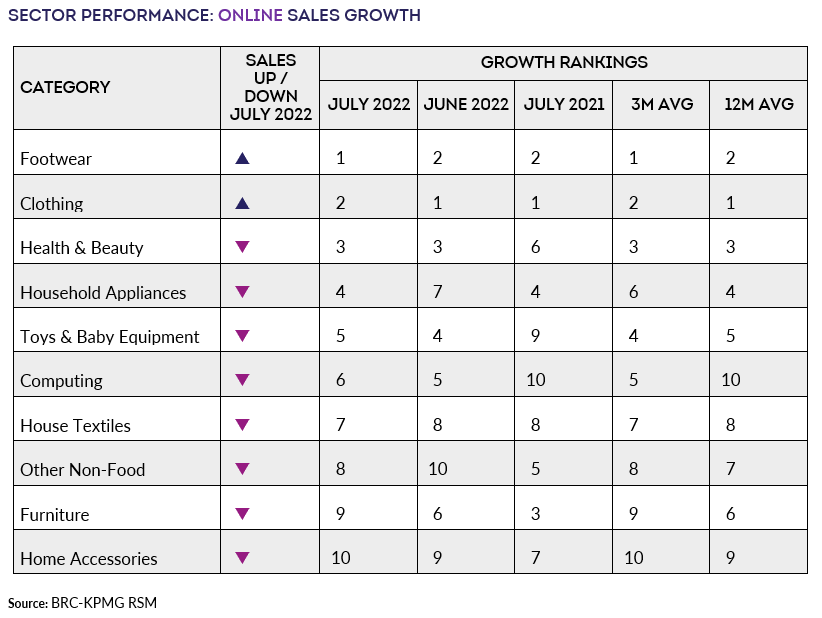

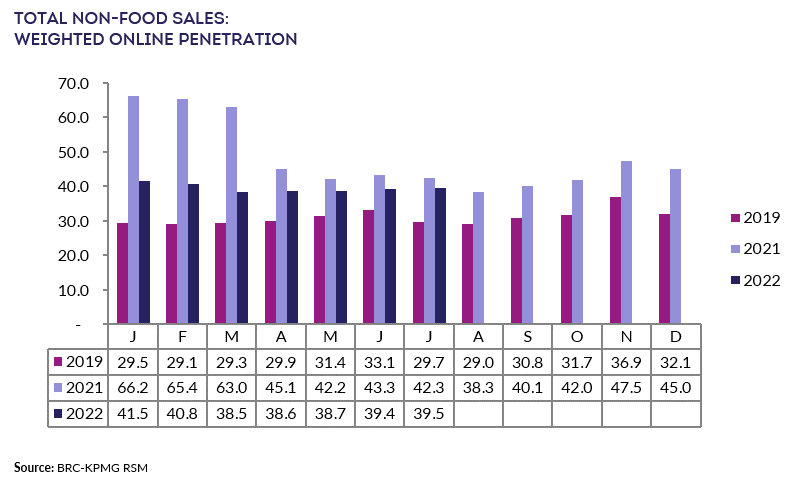

- Online Non-Food sales decreased by 3.9% in July, against a

decline of 0.6% in July 2021. This is above the 3-month average

decline of 7.3% and the 12-month decline of 14.1%.

- The Non-Food Online penetration rate decreased to 39.5% in

July from 42.3% at the same point last year.

Helen Dickinson OBE, Chief Executive | British Retail

Consortium

“Sales improved in July as the heatwave boosted sales of hot

weather essentials. Summer clothing, picnic treats, and electric

fans all benefitted from the record temperatures as consumers

made the most of the sunshine. However, with inflation at over 9%

many retailers are still contending with falling sales volumes

during what remains an incredibly difficult trading period.

“Consumer confidence remains weak, and the rise in interest rates

coupled with talk of recession will do little to improve the

situation. The Bank of England now expects inflation to reach

over 13% in October when energy bills rise again, further

tightening the screws on struggling households. This means that

both consumers and retailers are in for a rocky road throughout

the rest of 2022.”

, UK Head of Retail at

KPMG | KPMG

“The sun came out for retailers in July, as like for like sales

grew 1.6% on last year. Against a backdrop of the cost of

living crisis and on-going reports of low consumer confidence

actual sales are still holding up. Online retailers also

saw the benefit of warmer weather with sales growth falling more

slowly, by just 3.9% on July 2021.

“Despite consumer polls suggesting confidence is at an all-time

low, this hasn’t translated to money not being spent at the

tills, as consumers are determined to enjoy delayed holidays and

an unrestricted summer. Pent up demand, especially for new

clothes, has so far been at significant enough levels to keep the

overall retail sector in relatively good health. With

travel and summer socialising back on the agenda, retailers will

be hoping the feel good factor continues into August.

“However, the summer could be the lull before the storm with

conditions set to get tougher as consumers arrive back from

summer breaks to holiday credit card bills, another energy price

hike and rising interest rates. With stronger cost of

living headwinds on the horizon, consumers will have to

prioritise essentials, and discretionary product spending will

come under pressure. As margins continue to be challenged, and

costs continuing to rise, a significant drop in demand come the

Autumn will have detrimental impact on the health of the retail

sector. Truly understanding individual customer buying patterns

and being able to differentiate these will become increasingly

more important for the sector.”

Food & Drink sector performance | Susan Barratt, CEO

| IGD

“July’s food and drink value sales were again flattered by

inflation, masking some ongoing dips in sales volumes. Shoppers

are genuinely tightening their belts by buying fewer items in

addition to switching stores and buying more private label

products.

“Our Shopper Confidence Index improved a little in July, no doubt

boosted by England’s Lionesses successful Euro 2022 football

campaign. Plus, the heatwave and one in four families receiving

the first cost of living payment, fewer were impacted by rising

energy bills (68% compared to 74% in April ’22). However, with

food price inflation forecast to increase in the coming months

and Ofgem expected to announce a significant increase in the

energy price cap at the end of August, there are still

significant challenges ahead.”