During the pandemic much of retail bounced between being open and

closed, significantly impacting sales and changing consumer

behaviours. In January 2021, Scottish retail was in lockdown,

pushing many consumers to buy goods online. In this context, all

comparisons are provided on a year-on-2-year (Yo2Y) basis, we

have also included comparisons with January 2021 (YoY),

where relevant. This will be clearly signposted below.

Sales figures are not adjusted for inflation. Given that both the

January SPI (BRC) and December CPI (ONS) show inflation running

at historically high levels, a portion of the sales growth will

be a reflection of rising prices rather than increased

volumes.

Covering the four weeks 2 - 29 January

2022

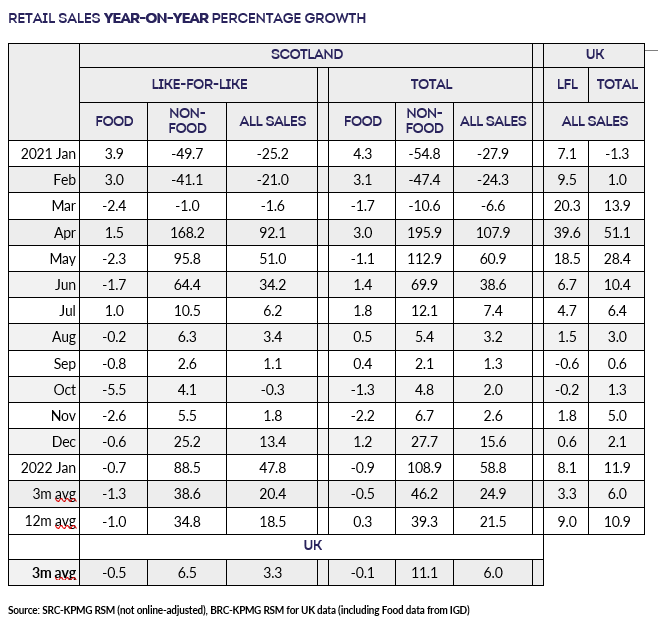

- Total sales in Scotland decreased by 7.9% compared with

January 2020, when they had increased by 1.3%. This was above the

3m average decrease of 11.6% and the 12-month average

decrease of 10.8%.

-

The January performance is an improvement of 5.1 percentage

points from December 2021 and is the lowest Yo2Y decline

recorded since July last year.

- Scottish sales decreased by 3.0% on a Like-for-Like basis

compared with January 2020, when they had decreased by 0.1%. This

is above the 3-month average decrease of 10.1% and the 12-month

average decrease of 8.1%.

- Total Food sales increased 3.3% versus January 2020, when

they had increased by 2.7%. January was below the 3-month average

growth of 3.5% and the 12-month average growth of 4.3%. The

3-month average was below the UK level of 8.1%.

- Total Non-Food sales decreased by 17.3% in January compared

with the same month in 2020, when they had increased by 0.2%.

This was above the 3-month average decrease of 24.2% and the

12-month average decrease of 23.5%.

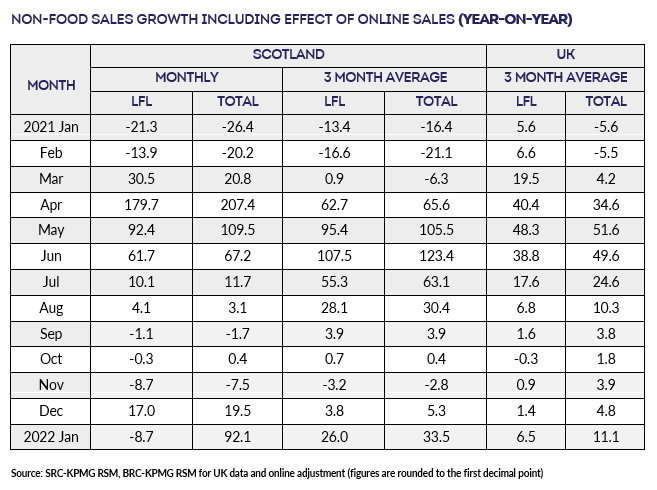

- Adjusted for the estimated effect of Online sales, Total

Non-Food sales decreased by 34.0% in January versus the same

month in 2020, when they had increased by 1.1%. This is above the

3-month average decline of 36.9% and below the 12-month average

decrease of 22.1%.

Ewan MacDonald-Russell, Head of Policy | Scottish Retail

Consortium

“January saw the best Scottish sales figures in six months as

shops kicked off 2022 with tentative signs of a recovery. Whilst

these figures are littered with caveats – the value of sales

remain nearly eight percent below pre-pandemic figures and are

bolstered by inflation – it’s nonetheless welcome to see an

improving performance after a dreadful end to 2021.

“Food sales fell back into negative territory compared to last

year, hardly surprising considering Scotland was locked down with

eateries shuttered, but were 3.3 percent up on 2020. However,

much of that growth derives from increased inflation which

grocers are now being forced to pass onto customers through

higher prices. Non-food sales were quite positive with

childrenswear, men’s smart clothing, and furniture all performing

well.

“It’s too early to tell if this is the start of a shopping

revival in Scotland, but these figures will provide a little

respite for a shattered retail industry. Nonetheless, there are

immense headwinds battering stores right now, with high

inflation, rising public policy costs, and stretched household

finances all making trading difficult. Hopefully there will be

brighter skies ahead, but it looks it will be sometime until we

arrive there.”

, Partner, UK Head of Retail |

KPMG

“An encouraging start to the year is welcome news, but with

inflation impacting both consumers and retailers, the months

ahead will require a balanced approach to drive growth. There are

clear signs we’re edging closer to traditional trading patterns

and sales falling back into line with pre-pandemic levels.

Normally a quiet trading month, January’s strong performance was

fuelled by non-food sales, with notable performers including

formal office wear, mirroring the return to the office for

many.

“It remains to be seen if sales will continue to grow and move

towards levels we saw before the pandemic. Scottish households

will be feeling the pinch in the months ahead, with rising energy

and fuel prices being compounded by inflation which is due to

peak in April. Retailers are facing their own inflationary

pressures and will need to take tough decisions on whether and

how to pass on the increased costs they have been sitting on for

some time to consumers facing their own financial challenges. We

could easily see the health of the sector start to deteriorate if

consumers choose to sit on savings to weather the storm.”